Journal of Political Economy, 2023,

Accepted

1 / 11

2 / 11

3 / 11

4 / 11

5 / 11

6 / 11

7 / 11

❮

❯

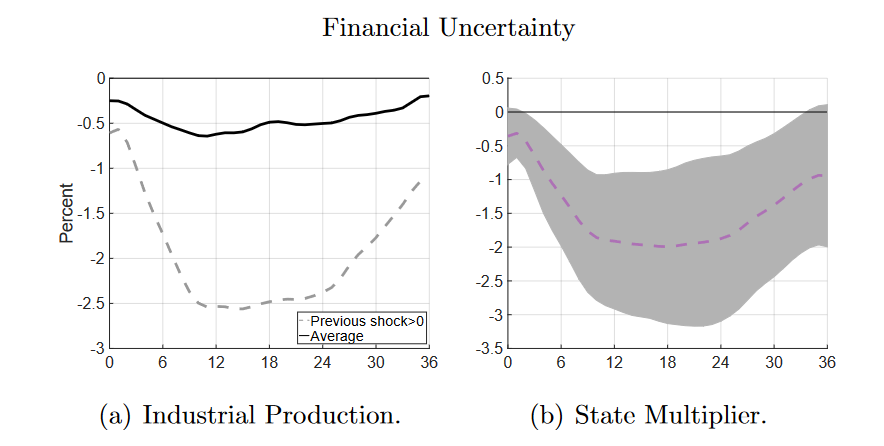

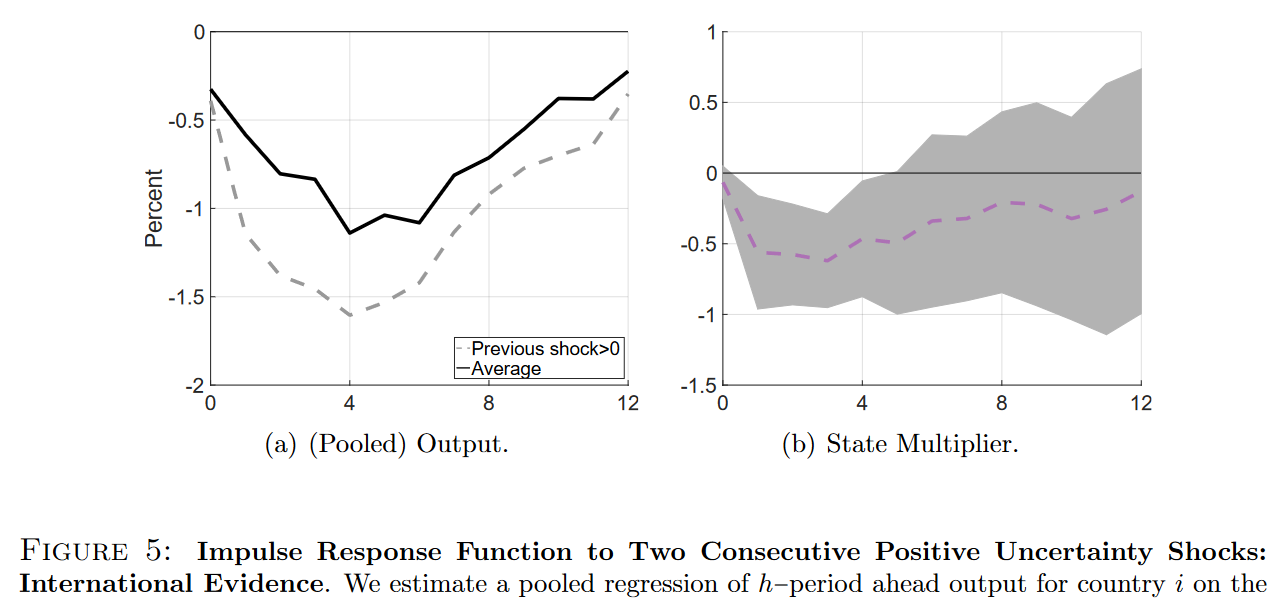

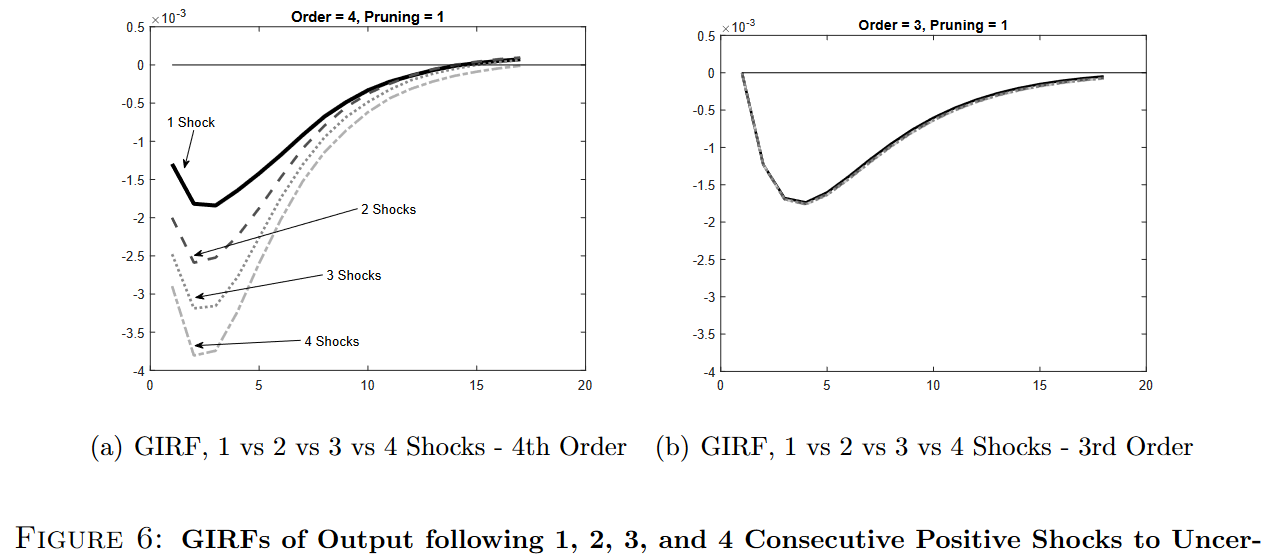

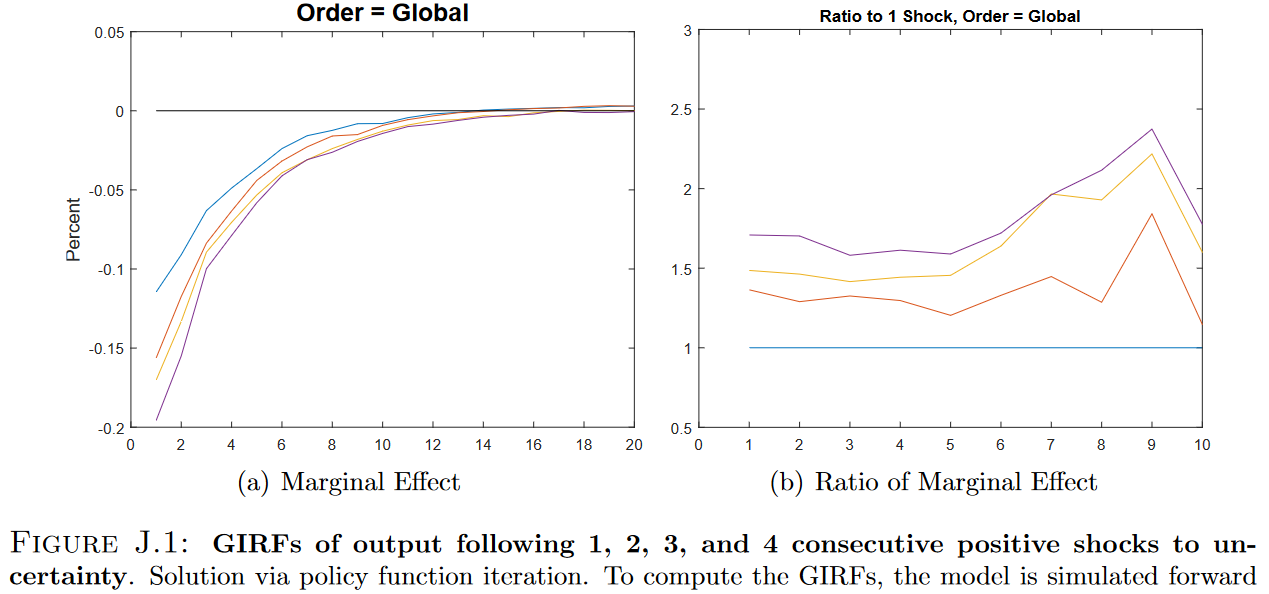

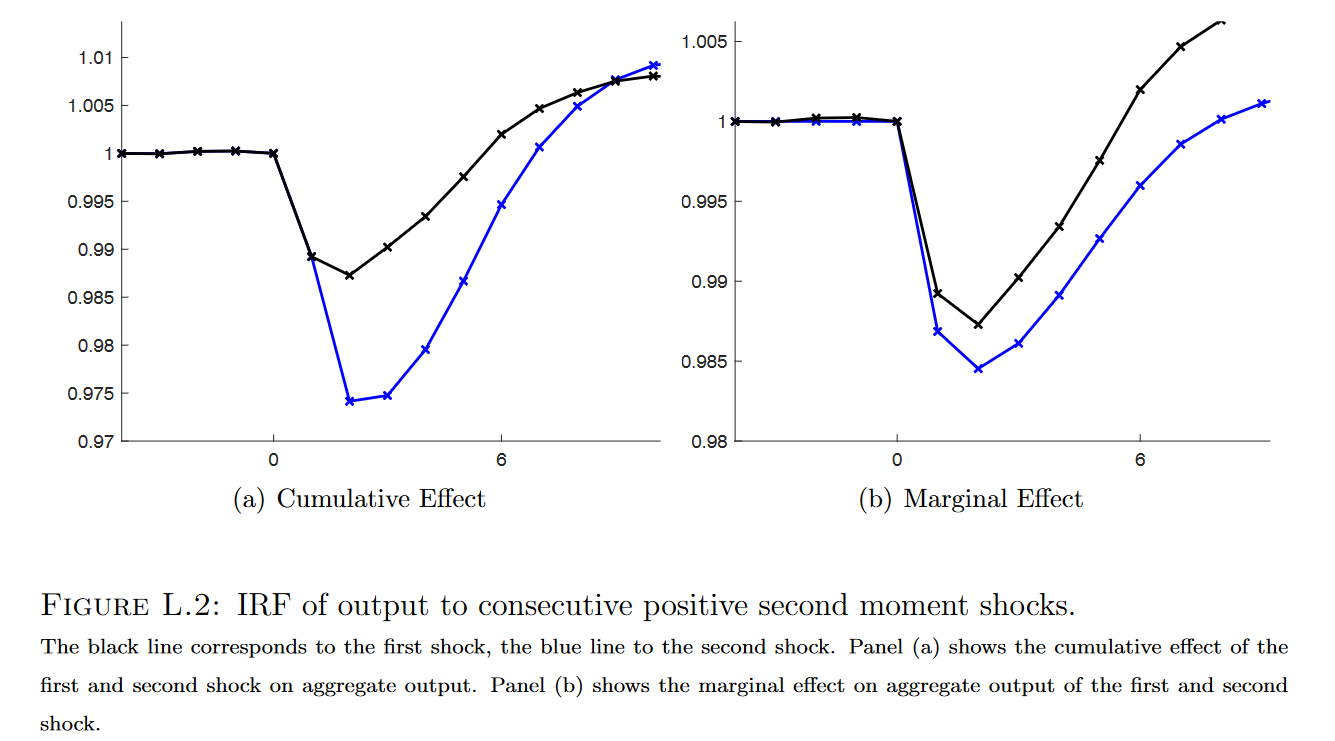

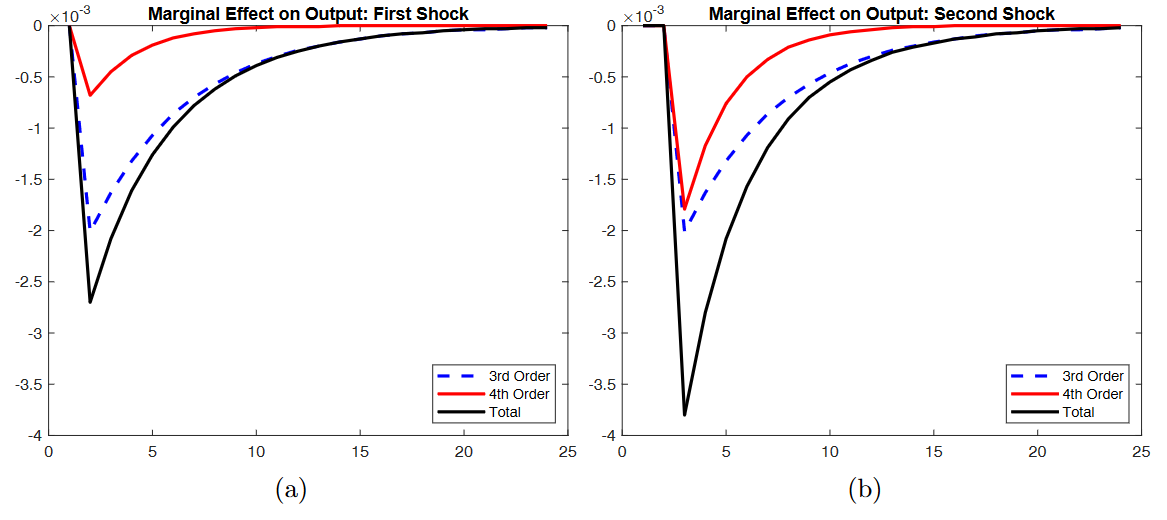

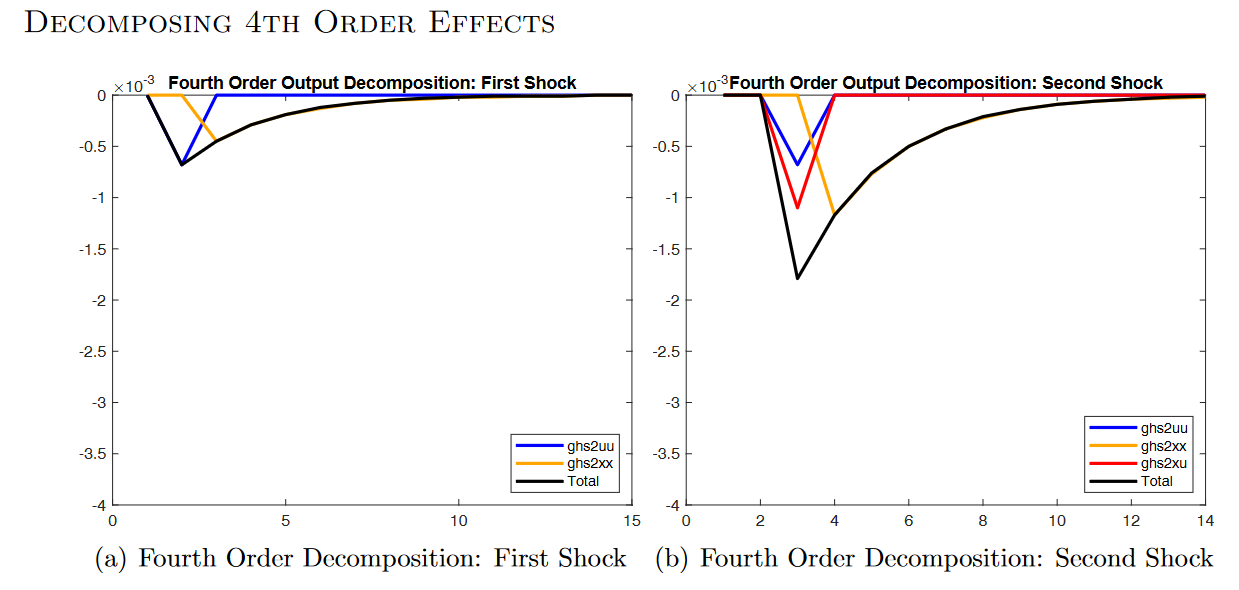

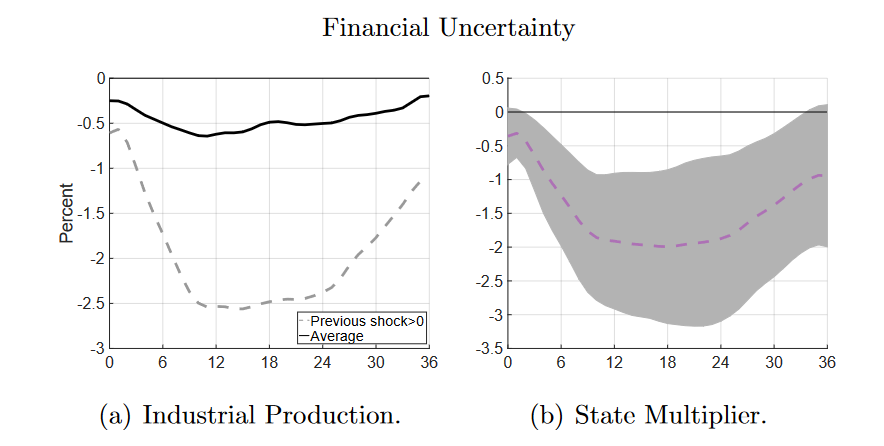

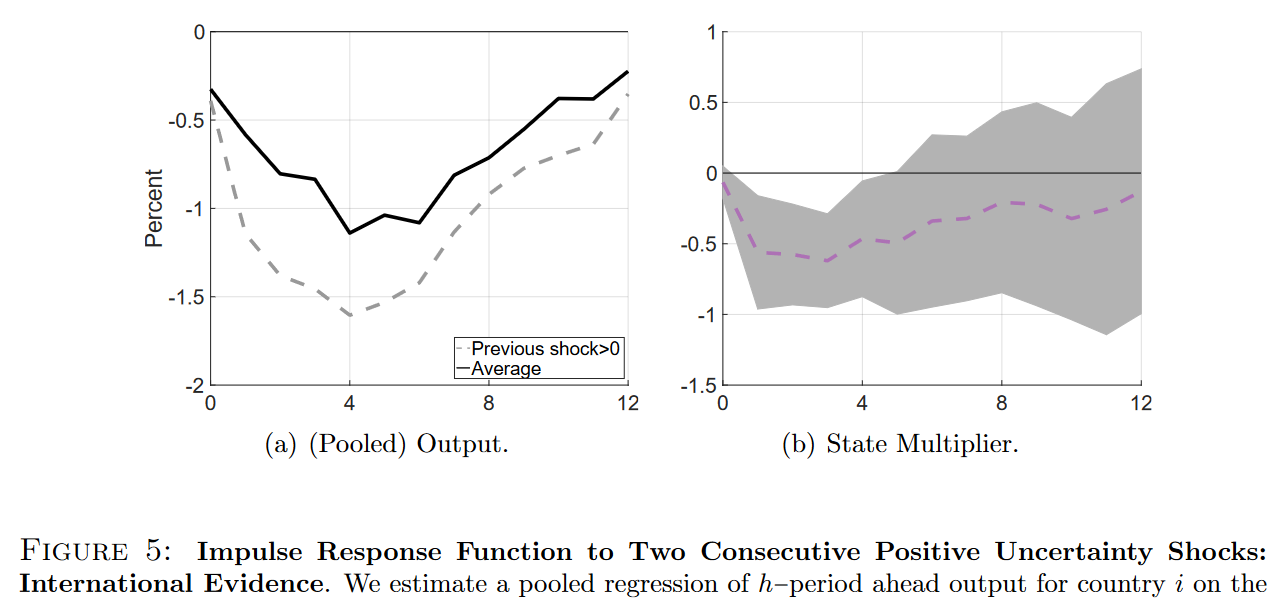

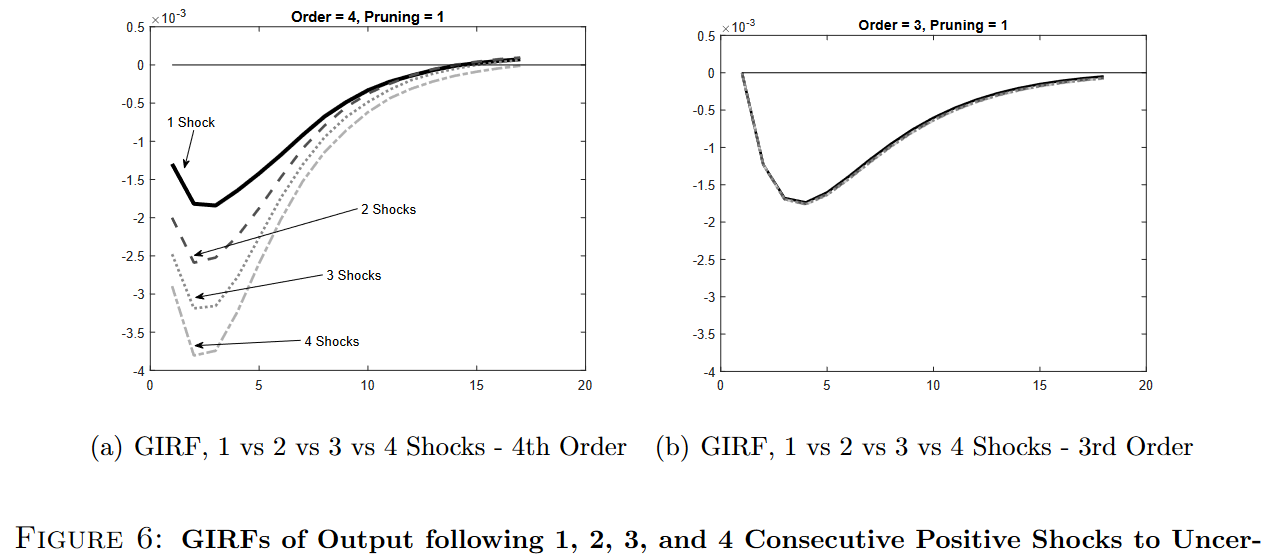

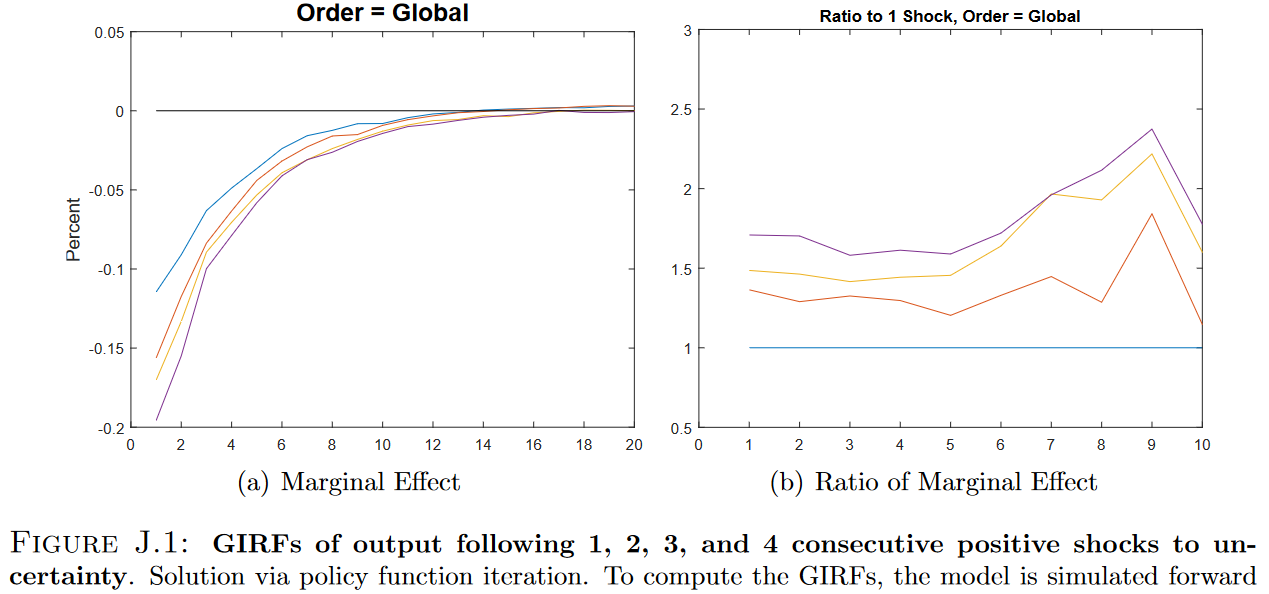

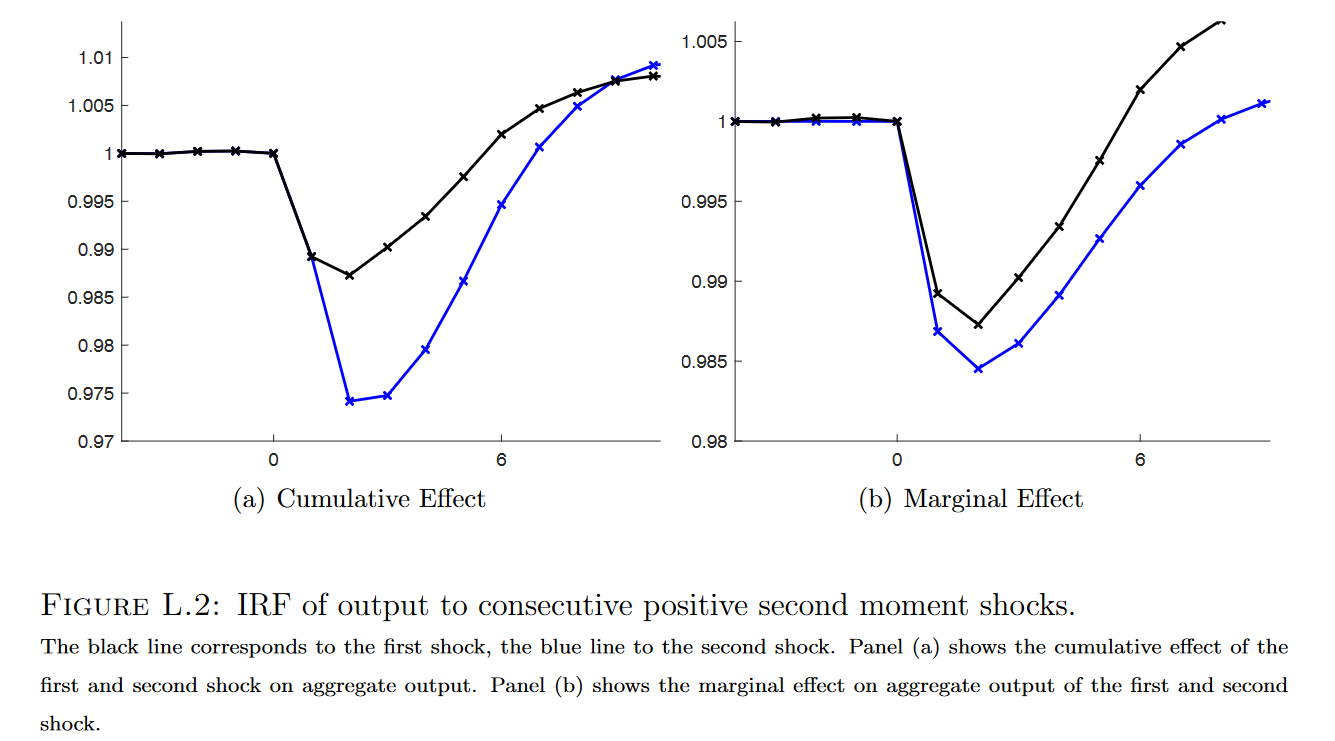

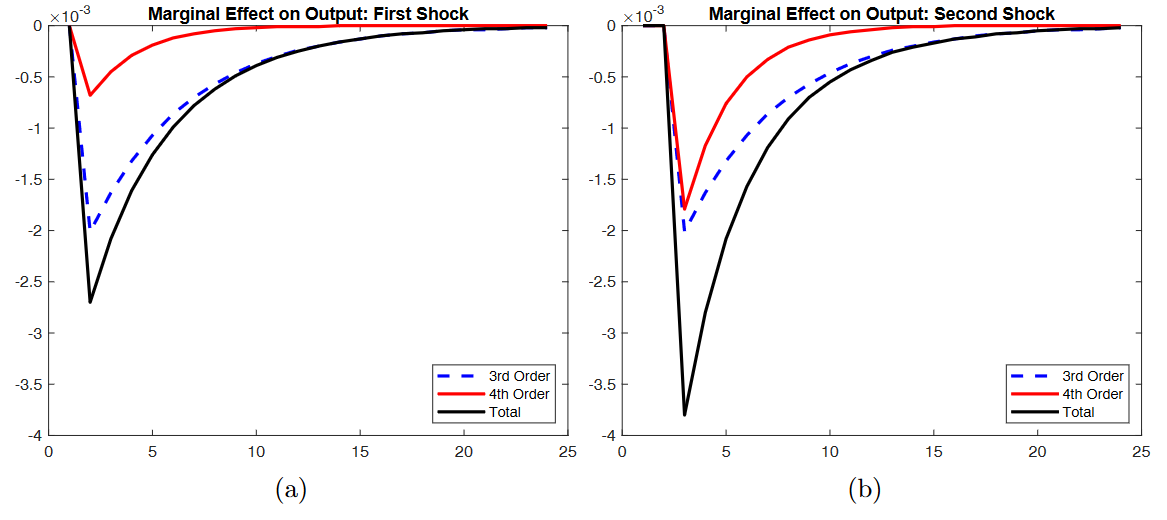

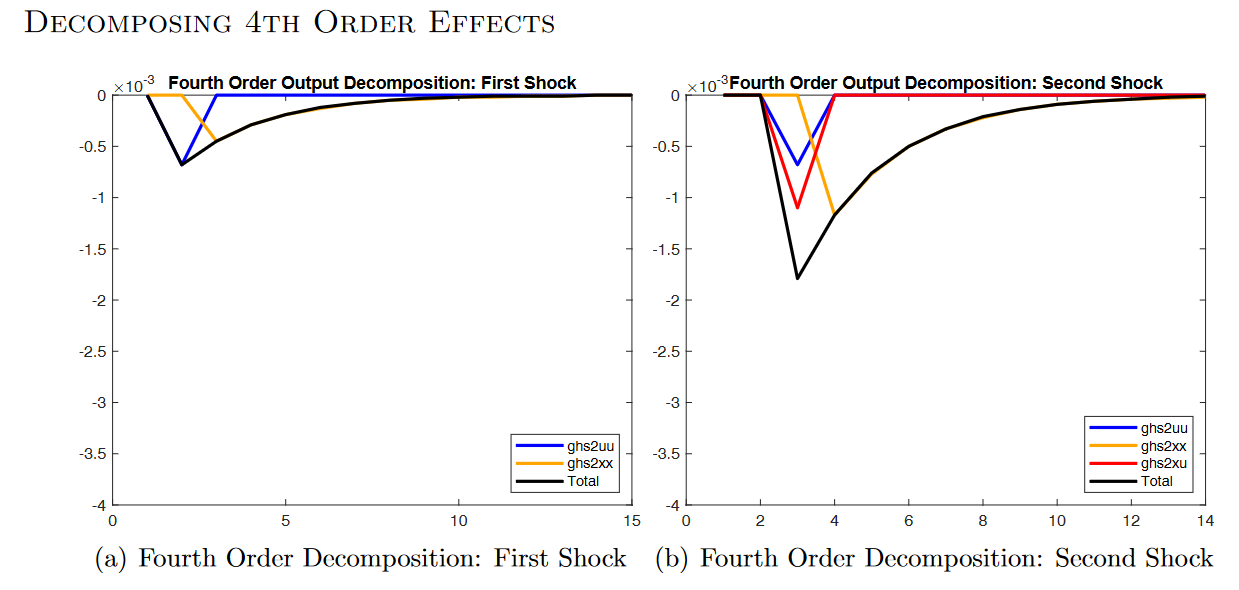

Abstract: The effects of uncertainty shocks are superadditive. Based on local projections,

we find the combination of nearby positive shocks can be multiple times more powerful than the sum of their standalone effects.

In a standard New-Keynesian DSGE model, uncertainty shocks are proven to be superadditive only when the model is solved under fourth (or higher) order perturbation.

The fourth order solution unlocks the fourth derivative of marginal utility, “edginess”, which is key to generating stronger reactions to multiple risks and superadditivity.

Intuitively, an agent already bearing one risk is less willing to bear another in the presence of edginess.

Abstract: Surveys of financial market participants are of particular interest to investors and policymakers—especially those at central banks—because they provide valuable information about market expectations for future economic outcomes, financial conditions, and policy actions. Surveys usually complement other sources of information—such as market pricing data or anecdotal information from market participants—but the rigor and structure of periodic surveys, as well as the absence of risk premiums, make them a valuable input into research, analysis, and decision-making. This chapter provides a broad overview of various surveys of financial market participants and highlights some of their advantages and potential drawbacks, both in theory and in practice.

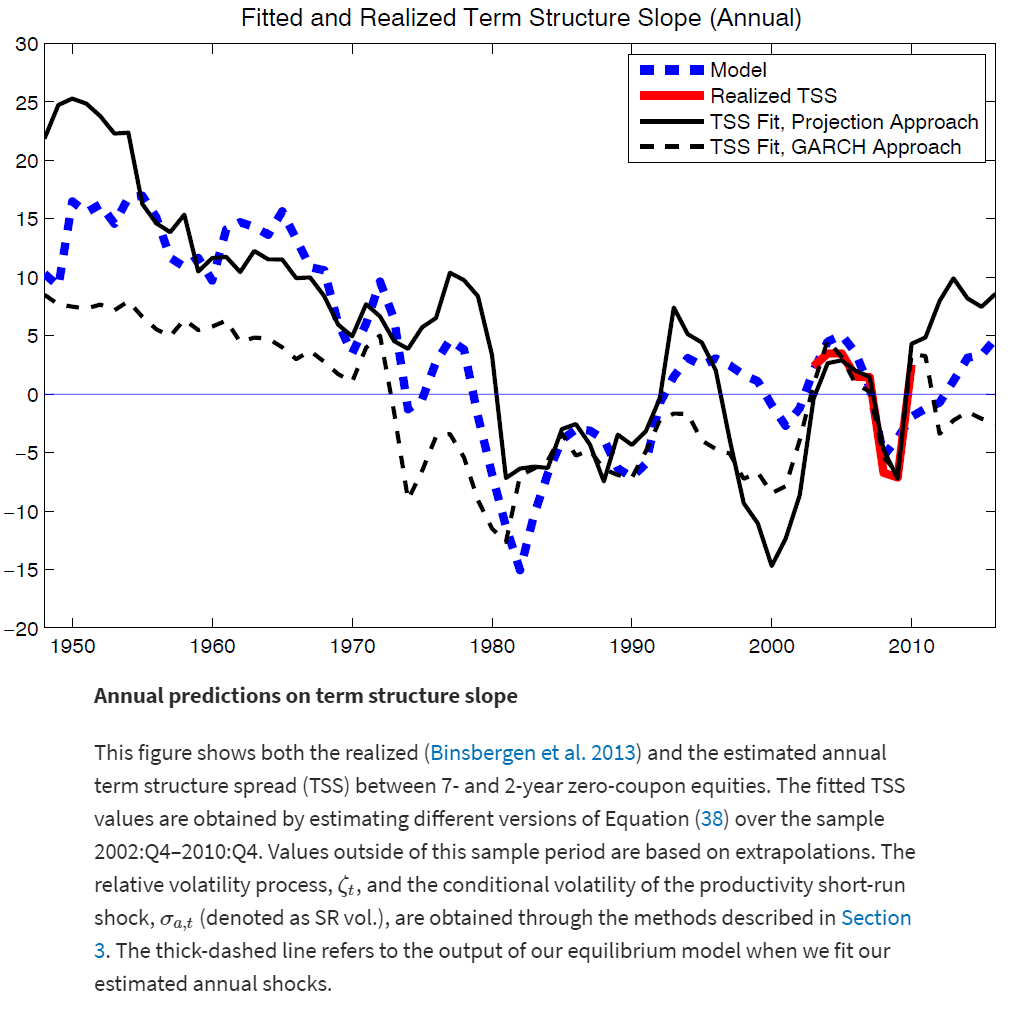

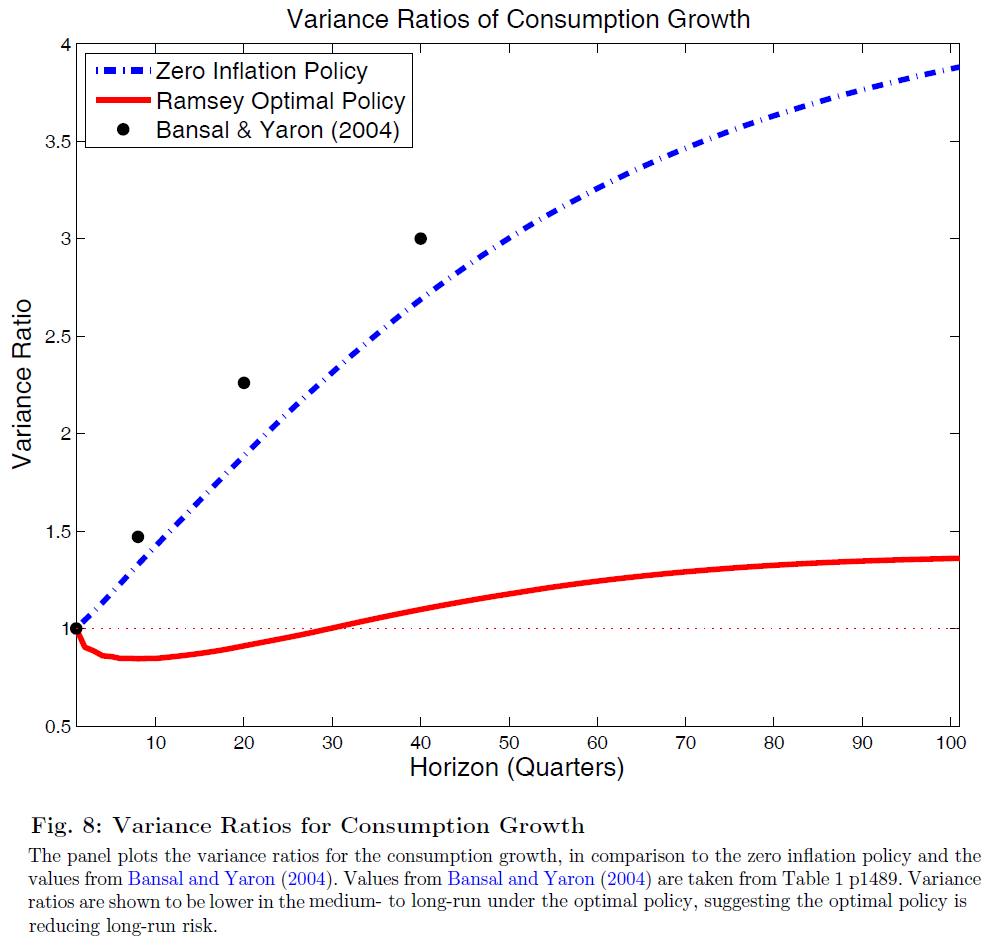

Abstract: We propose a production-based general equilibrium model to study the link between timing of cash flows and expected returns, both in the cross-section of stocks and along the aggregate equity term structure. Our model incorporates long-run growth news with time-varying volatility and slow learning about the exposure that firms have with respect to these shocks. Our framework provides a unified explanation of the stylized features of the slope of the term structure of equity returns, its variations over the business cycle, and the negative relationship between cash-flow duration and expected returns in the cross-section of book-to-market-sorted portfolios.

Revise and Resubmit, Review of Economics and Statistics 2023,

NBER WORKING PAPER

With J. Rawls and E. Sims

1 / 11

2 / 11

3 / 11

4 / 11

5 / 11

6 / 11

7 / 11

❮

❯

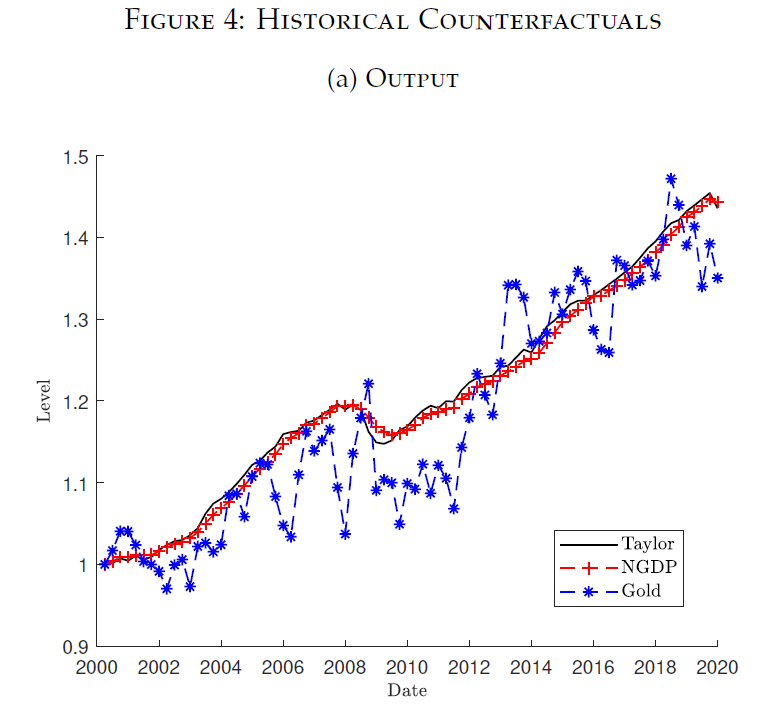

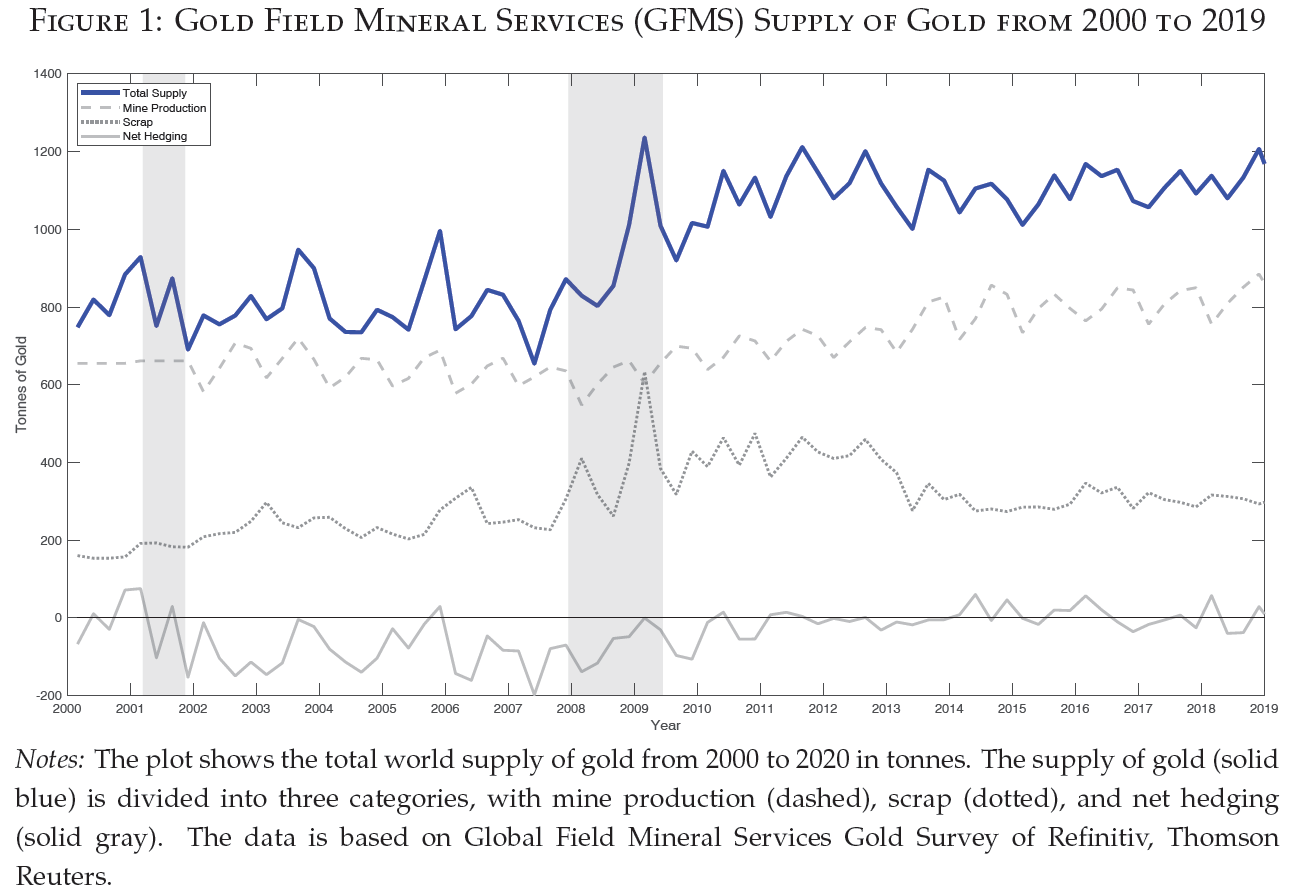

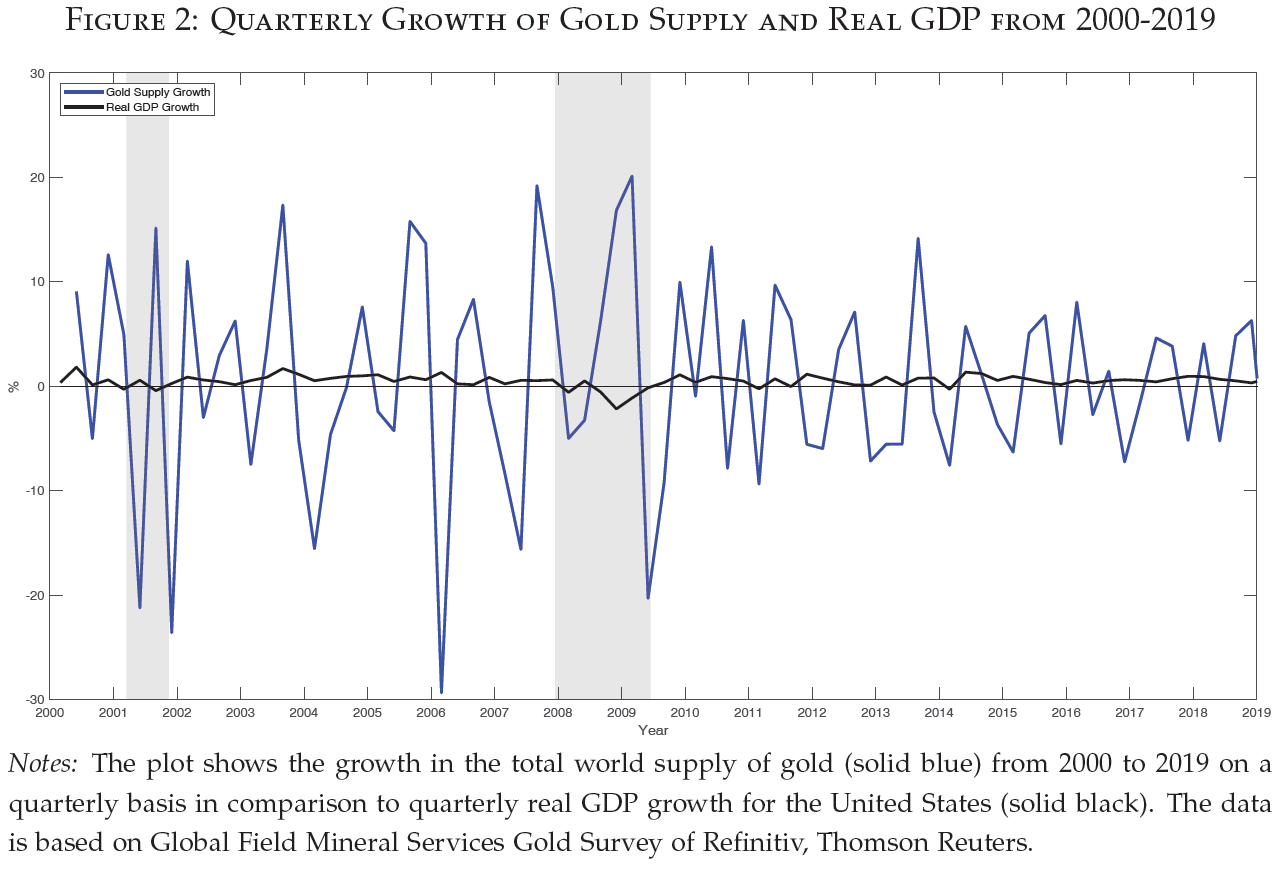

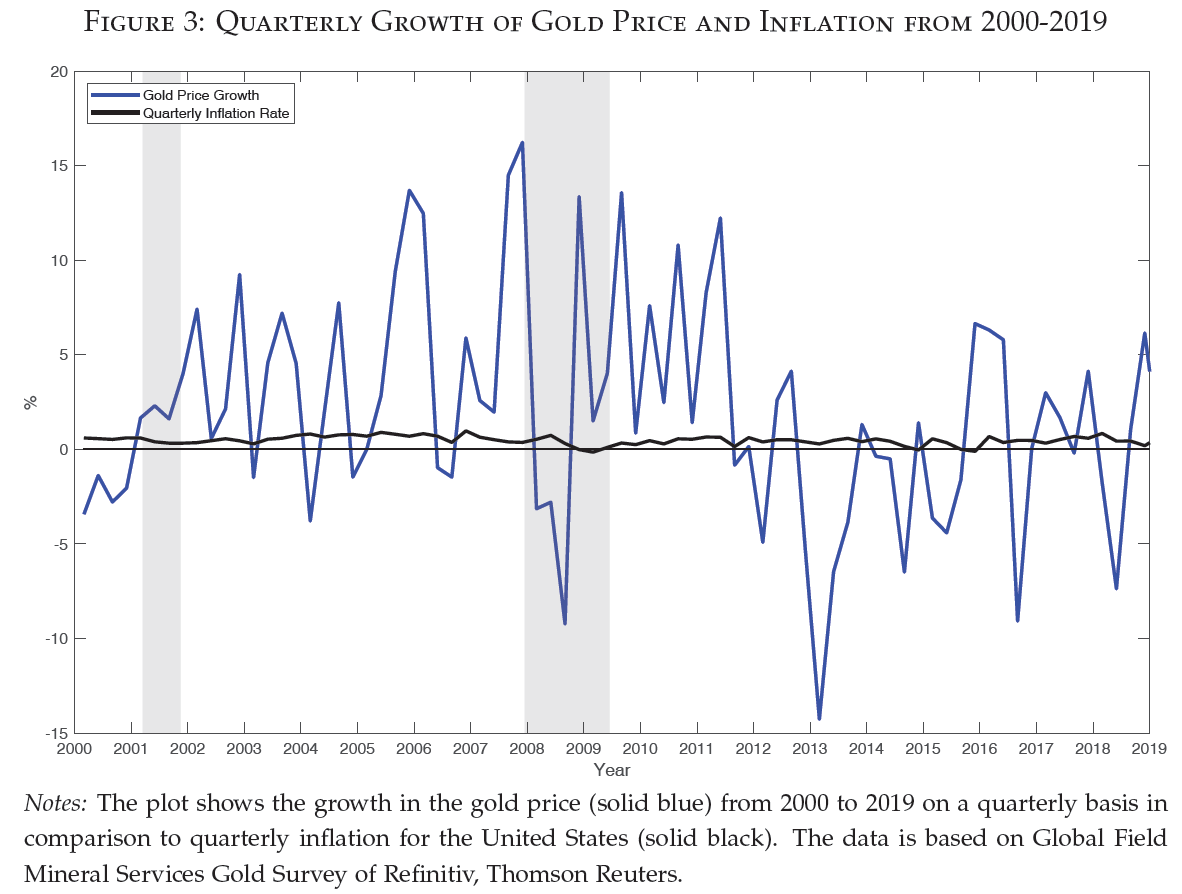

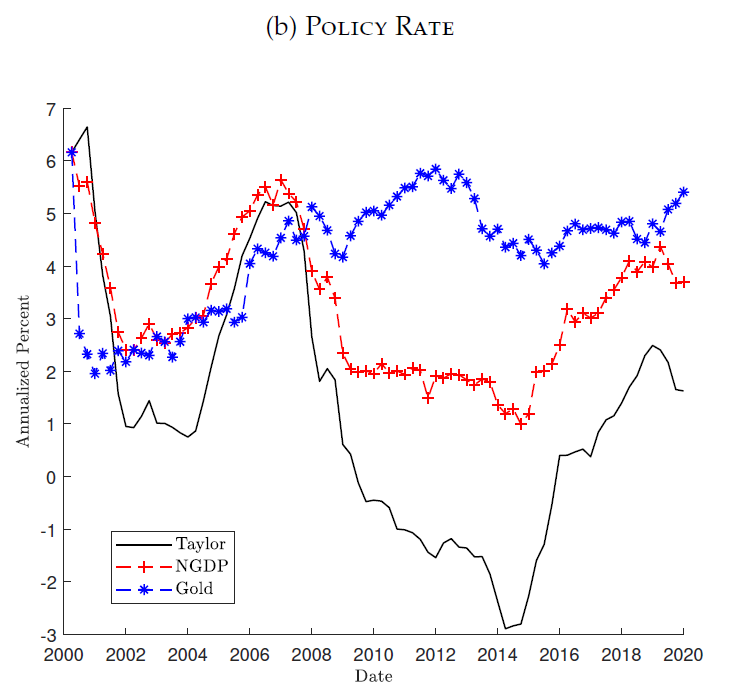

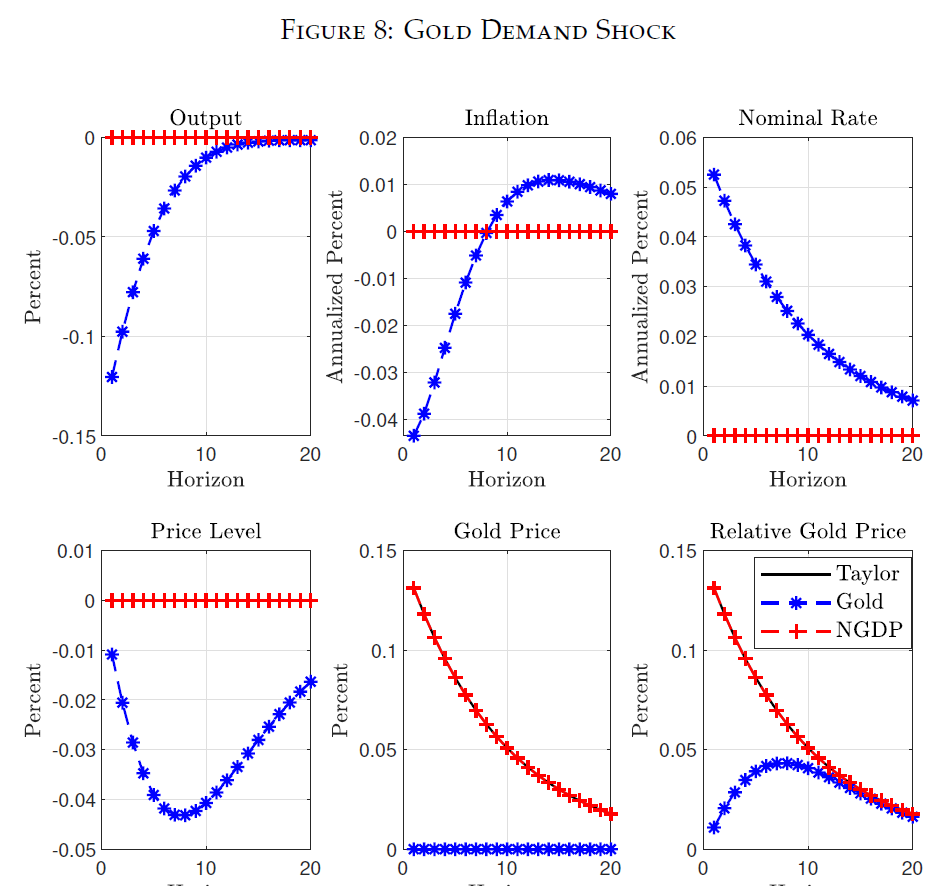

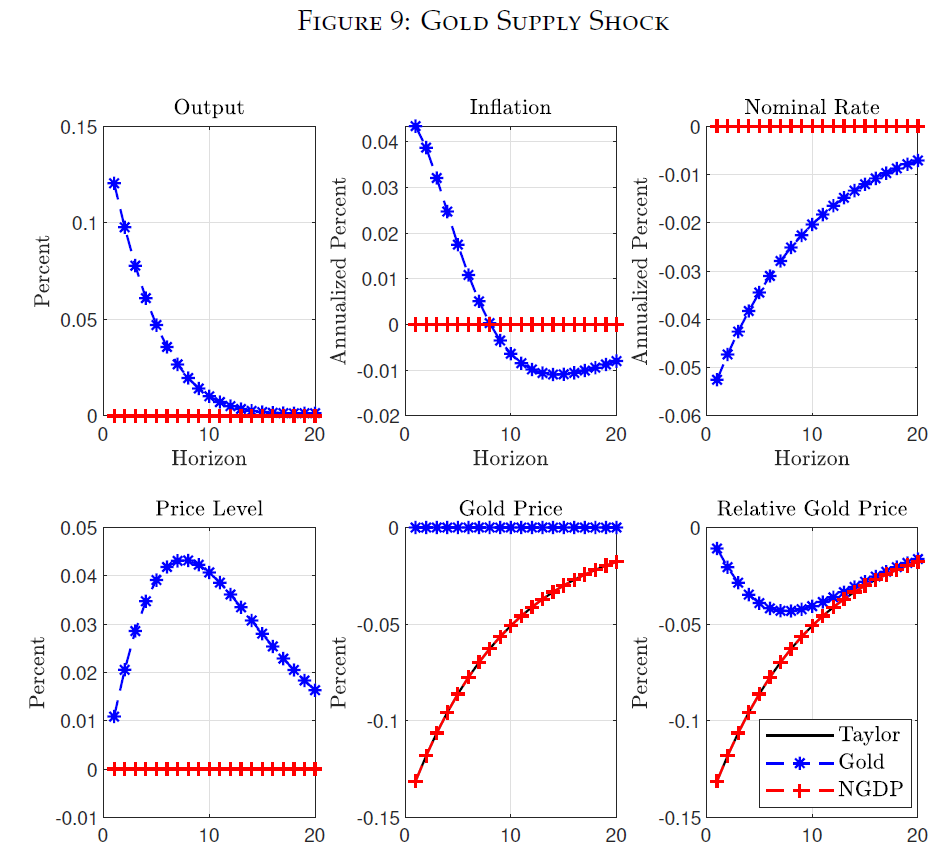

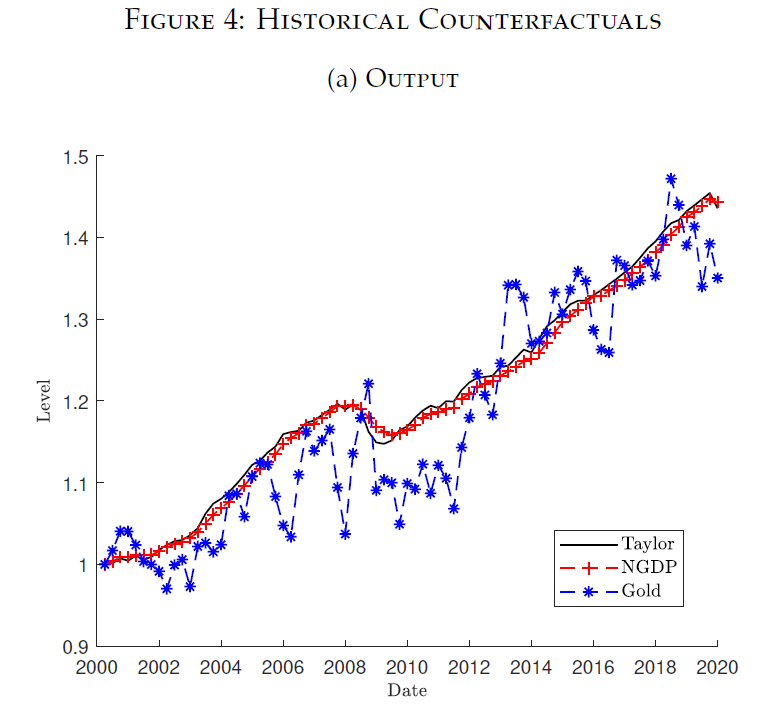

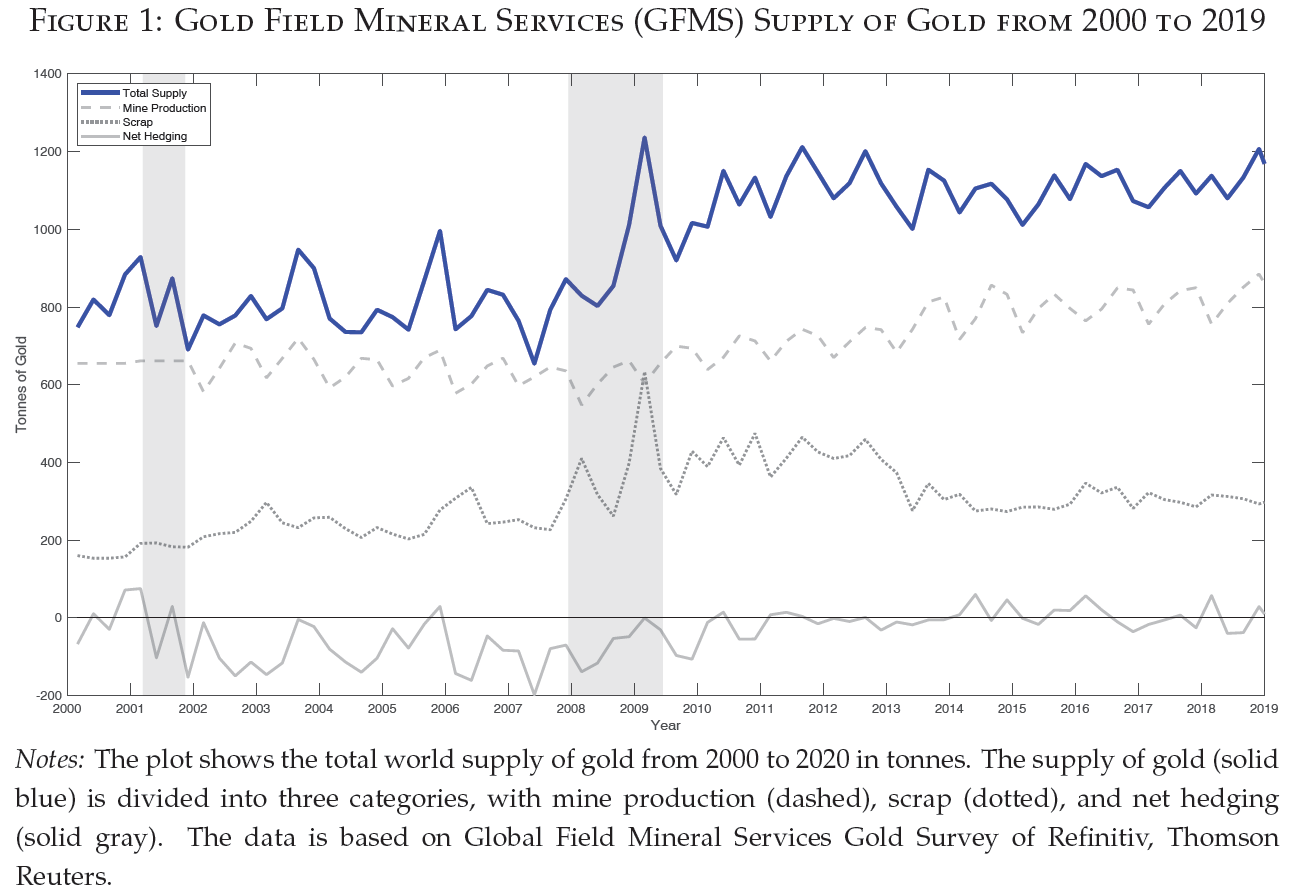

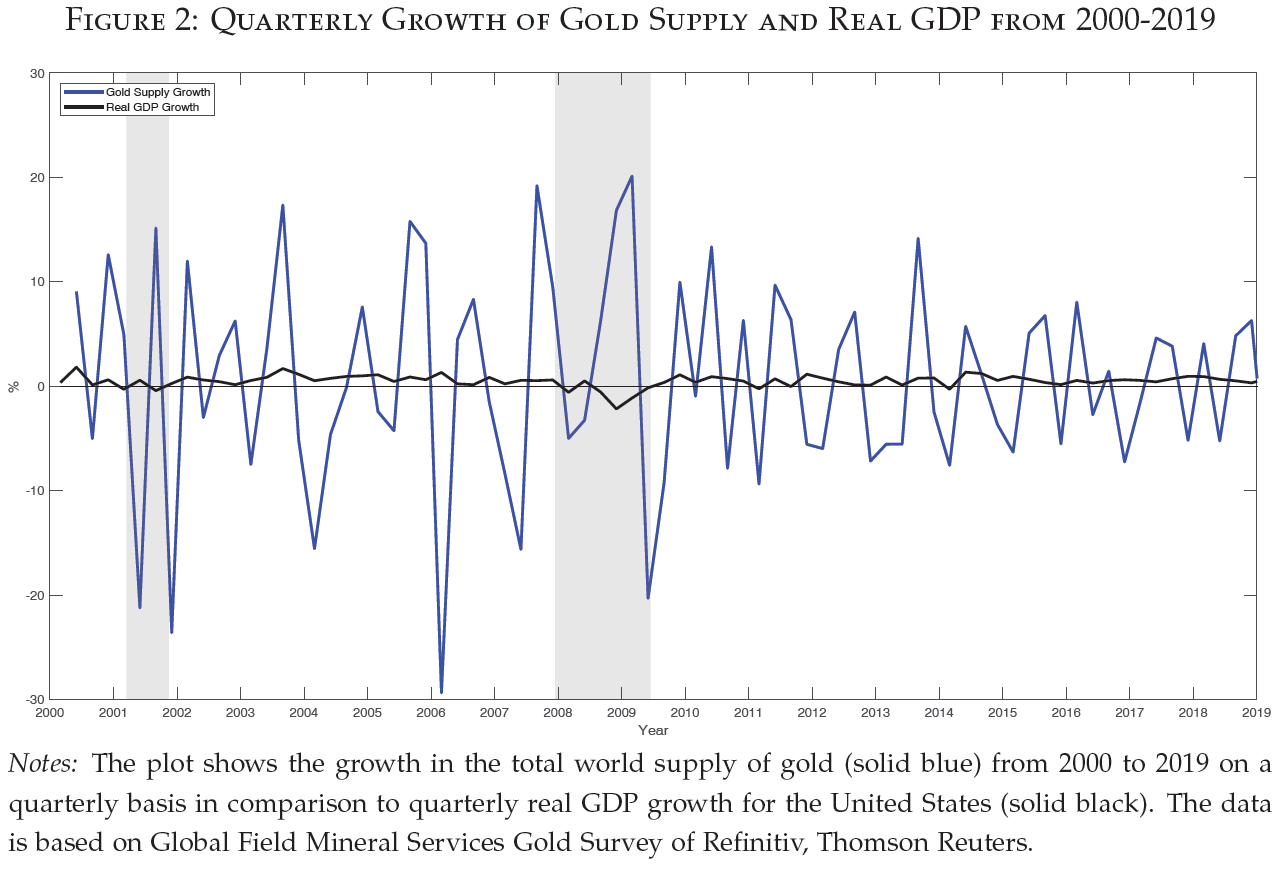

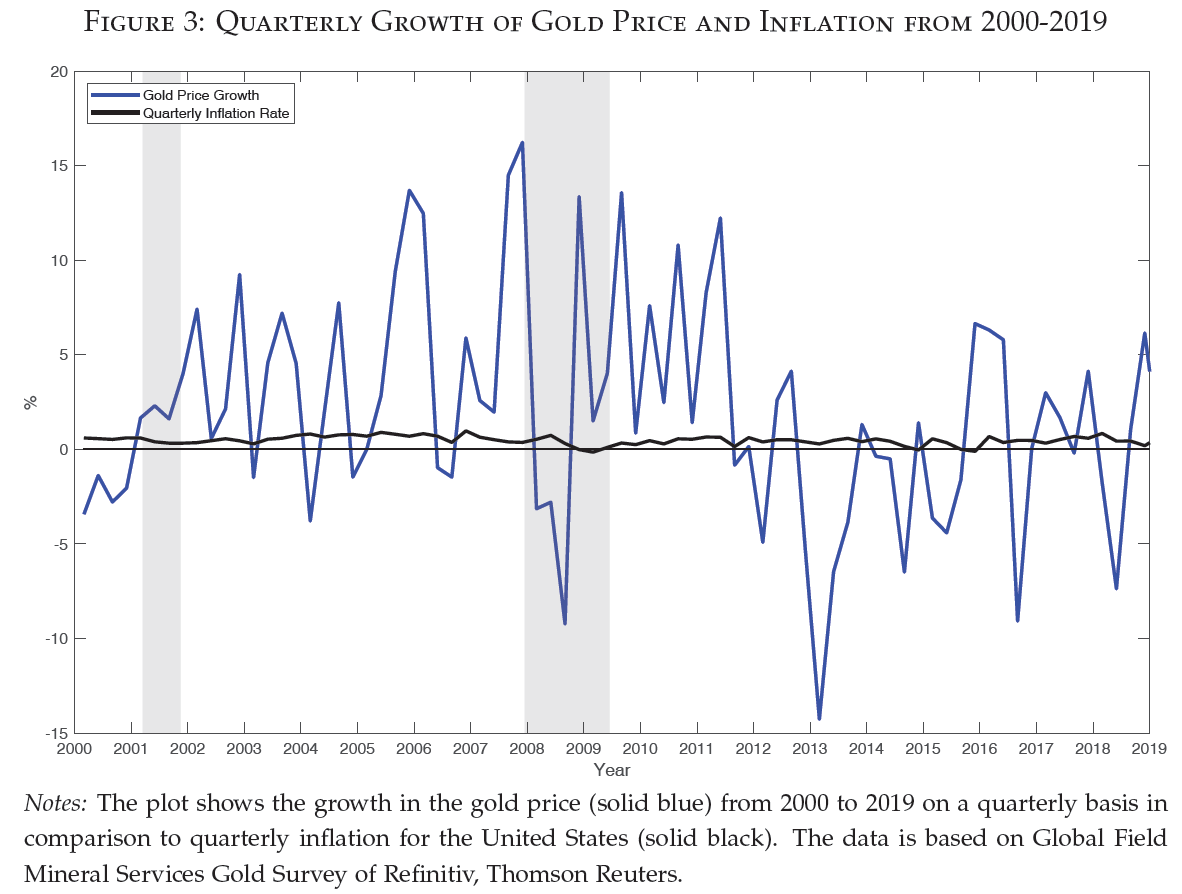

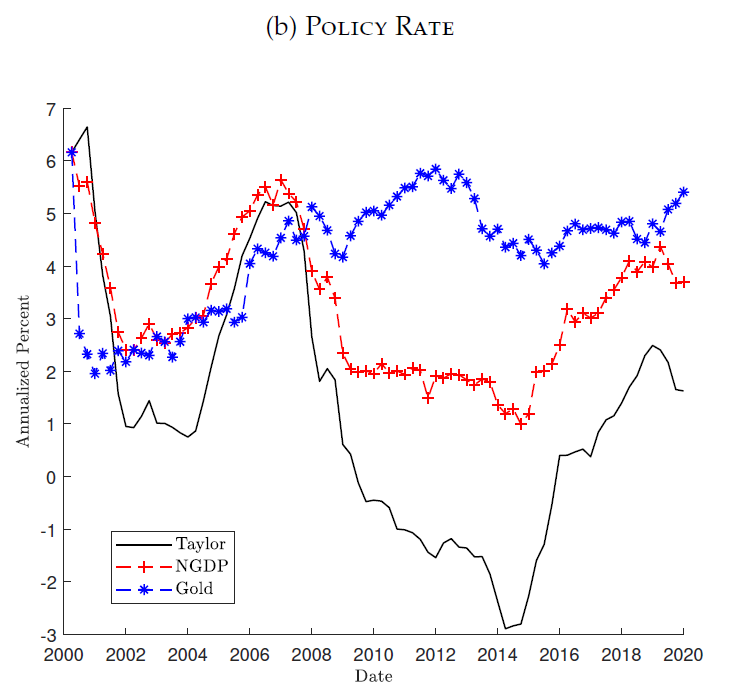

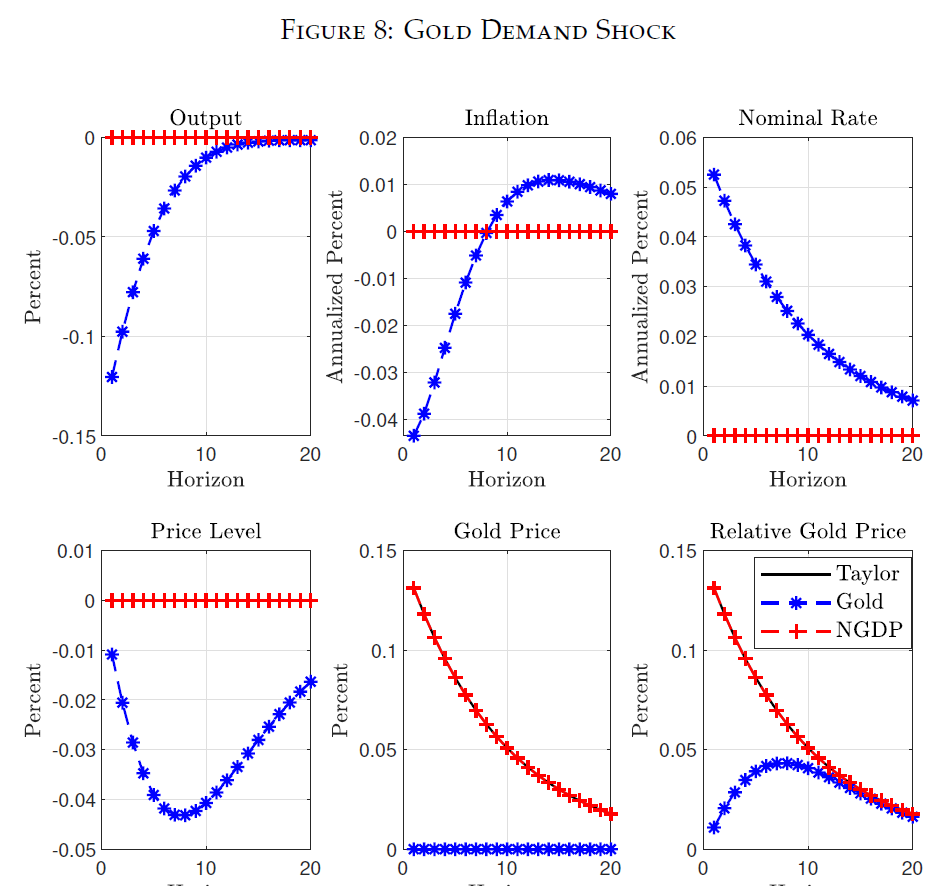

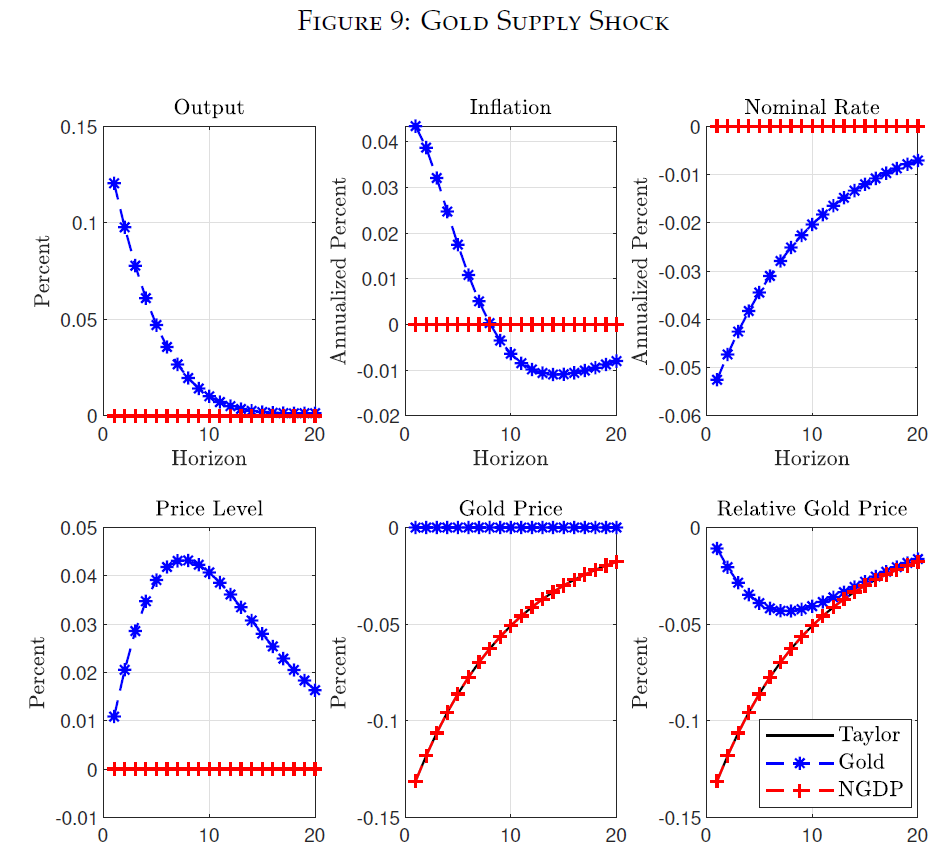

Abstract: This paper is one of the first to study the present-day properties of the gold standard in a quantitative model commonly used in central banks. We incorporate gold into an otherwise standard estimated New Keynesian model and compare the positive and normative implications of adopting a gold standard to other more commonly advocated policies. We show that under certain conditions, the gold standard is akin to a nominal GDP targeting framework and can at times be considered an improvement. However, unlike more conventional policies, the gold standard must react to shocks to the supply and demand for gold. We estimate the model for the post-2000 period using a novel dataset on the supply of gold and find that following a gold standard would result in dramatic increases in the volatilities of macroeconomic aggregates and a significant deterioration in household welfare. This is because the estimated shocks to gold supply and demand are significantly larger than for other more conventional aggregate shocks. In the end, what buries the gold standard turns out to be instability in the dynamics of gold itself.

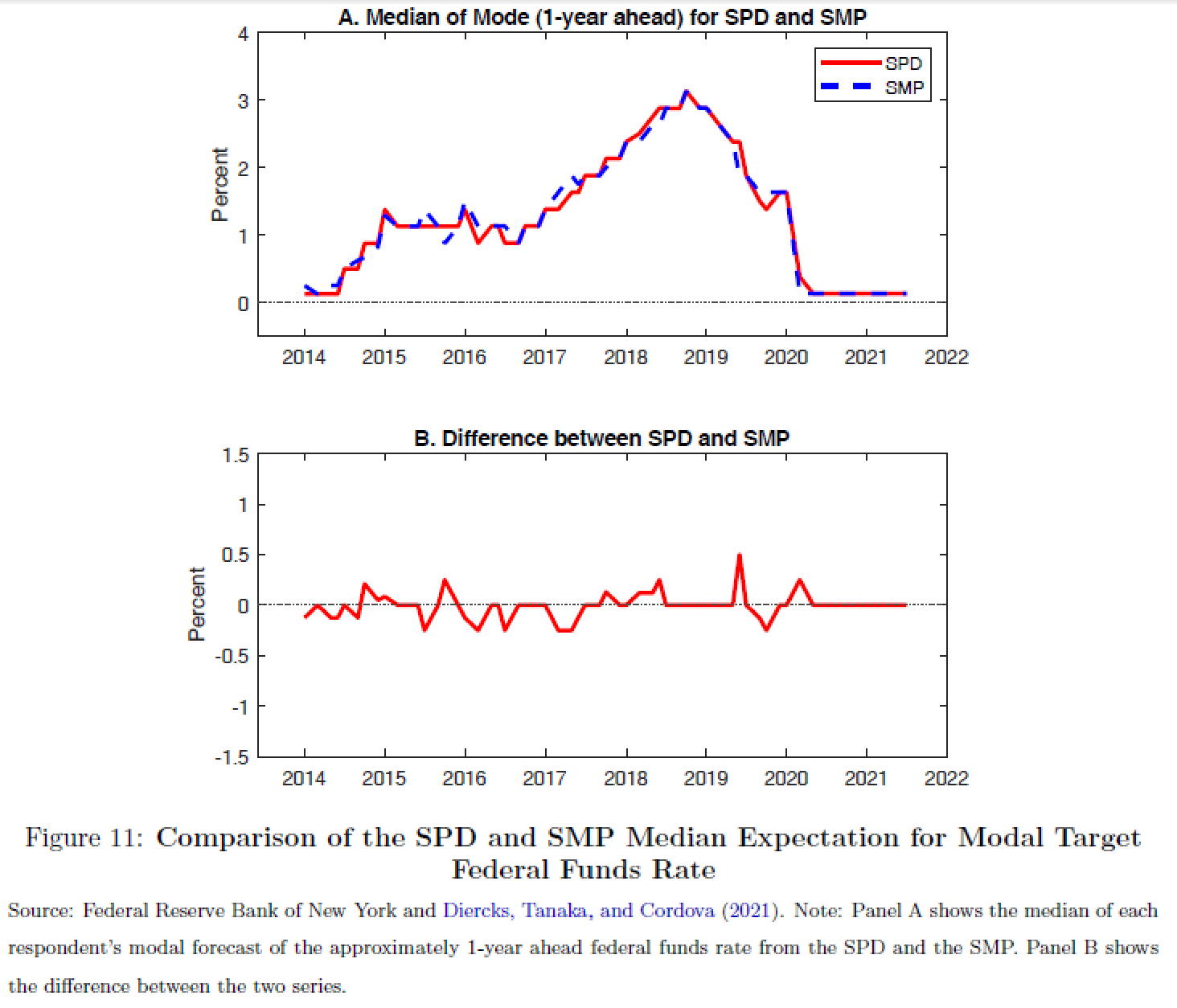

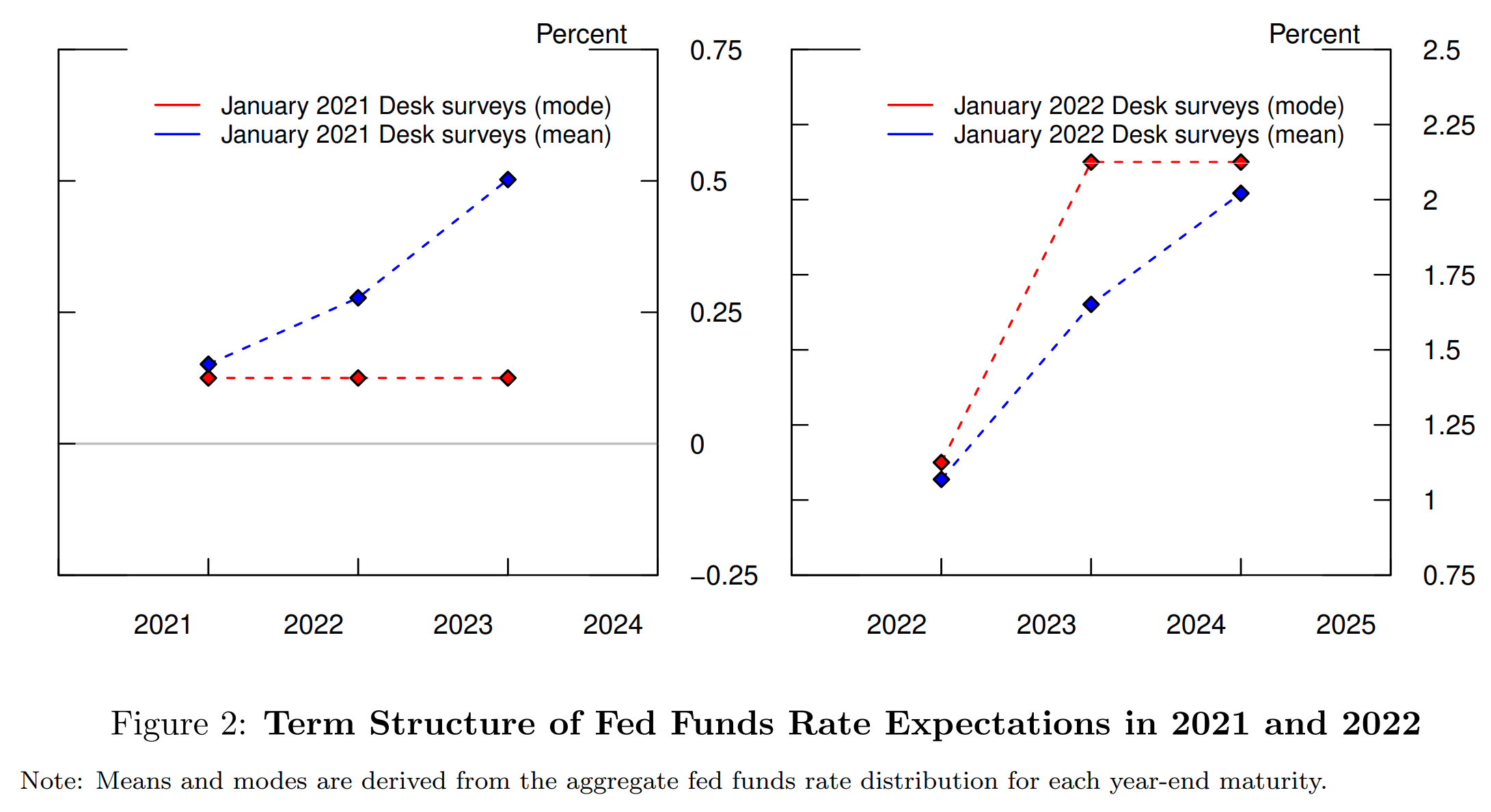

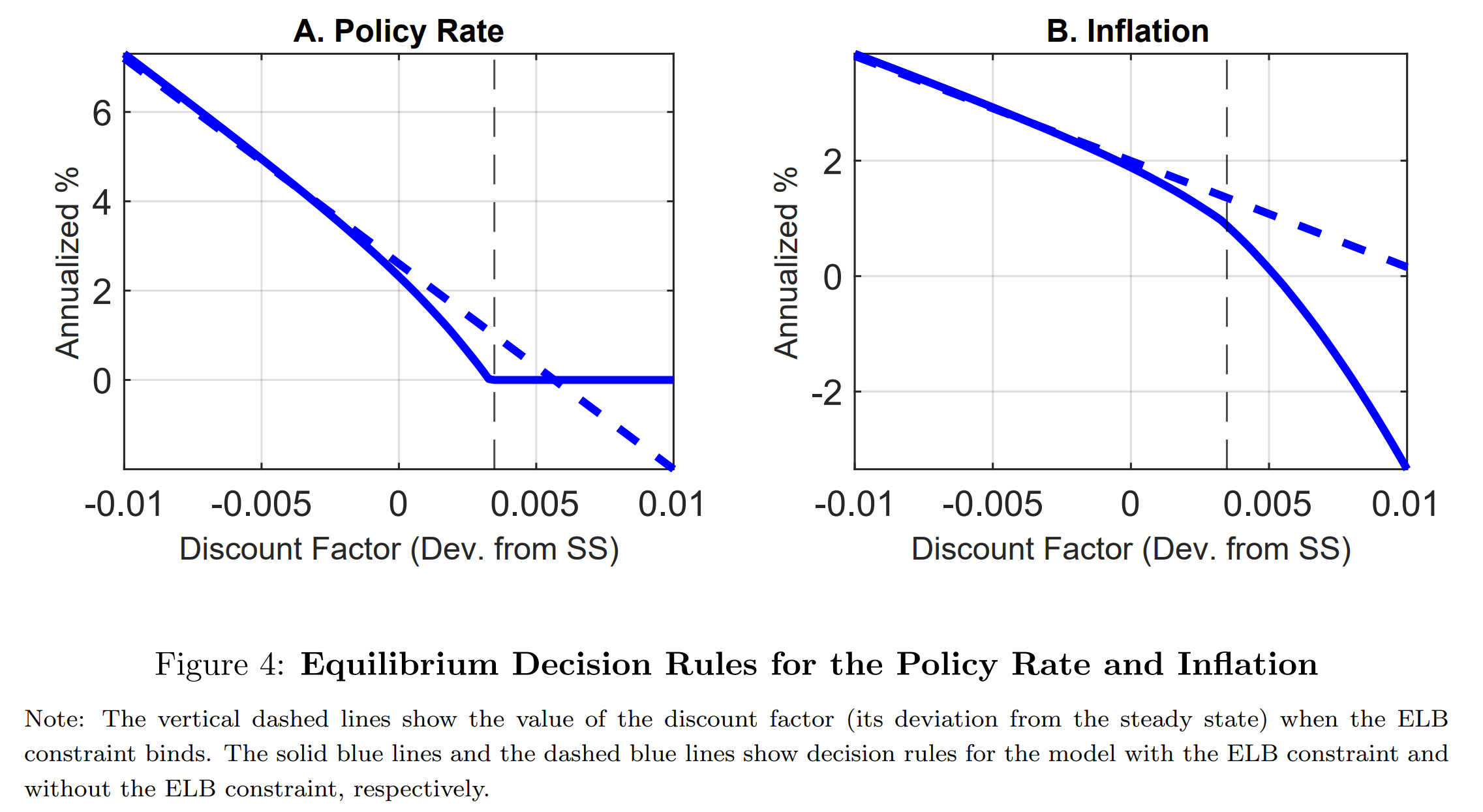

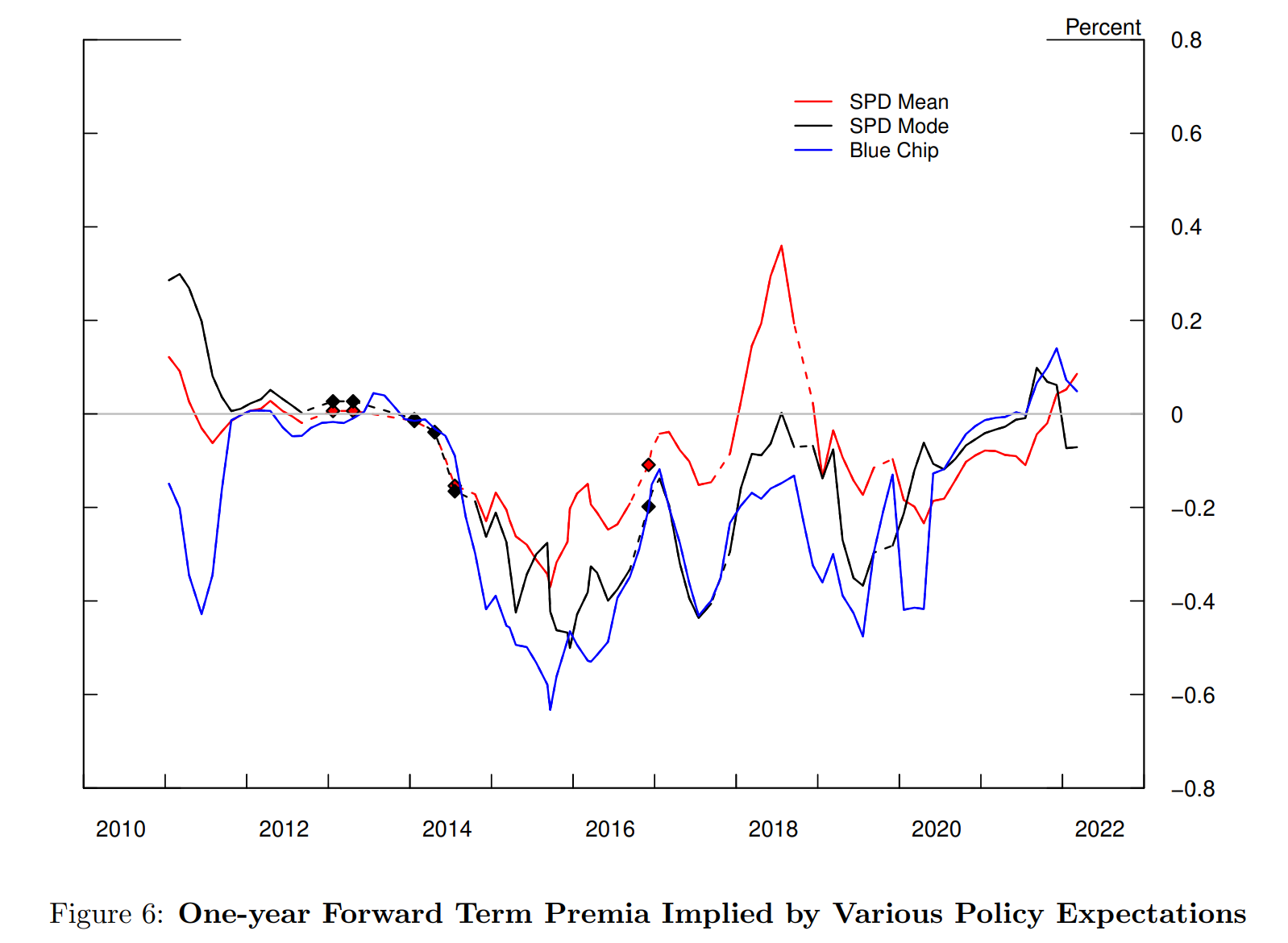

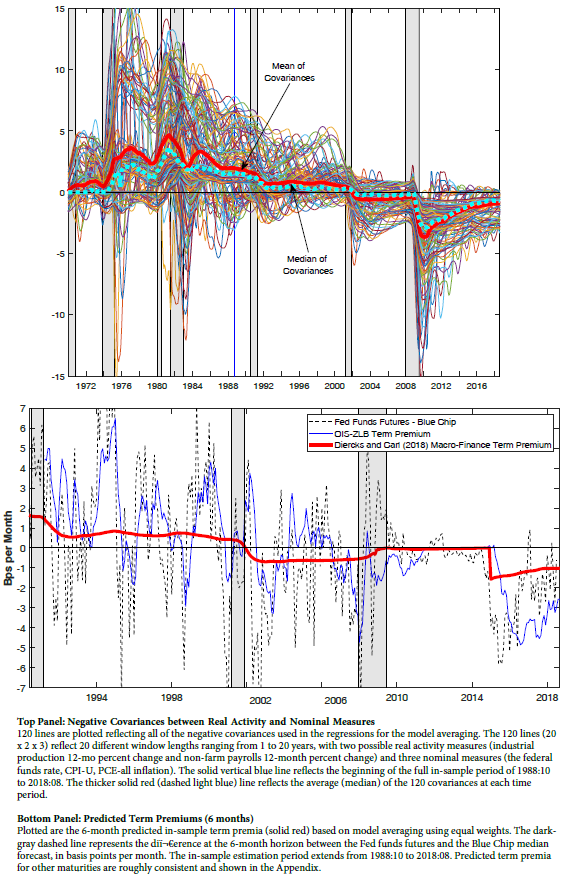

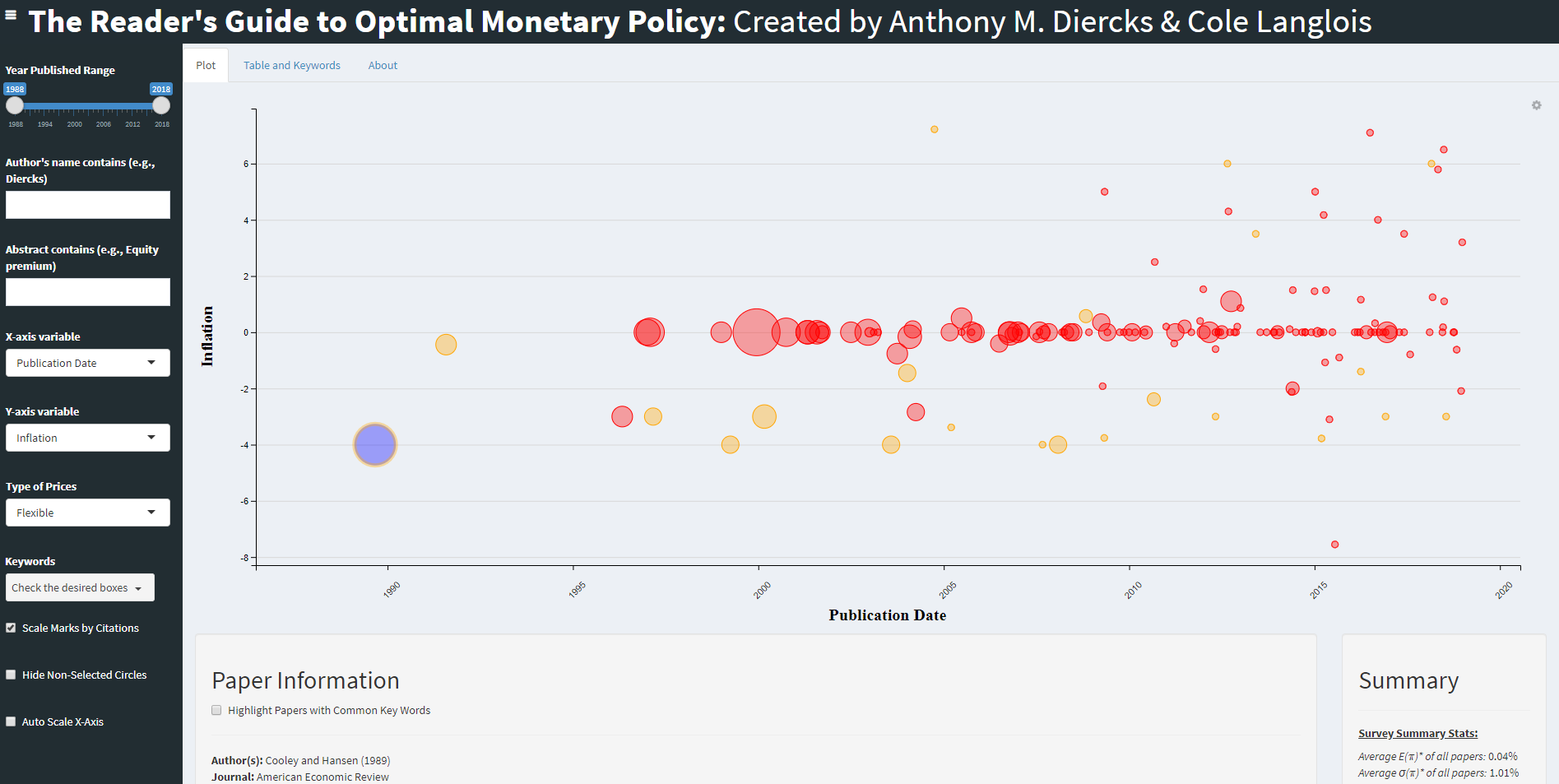

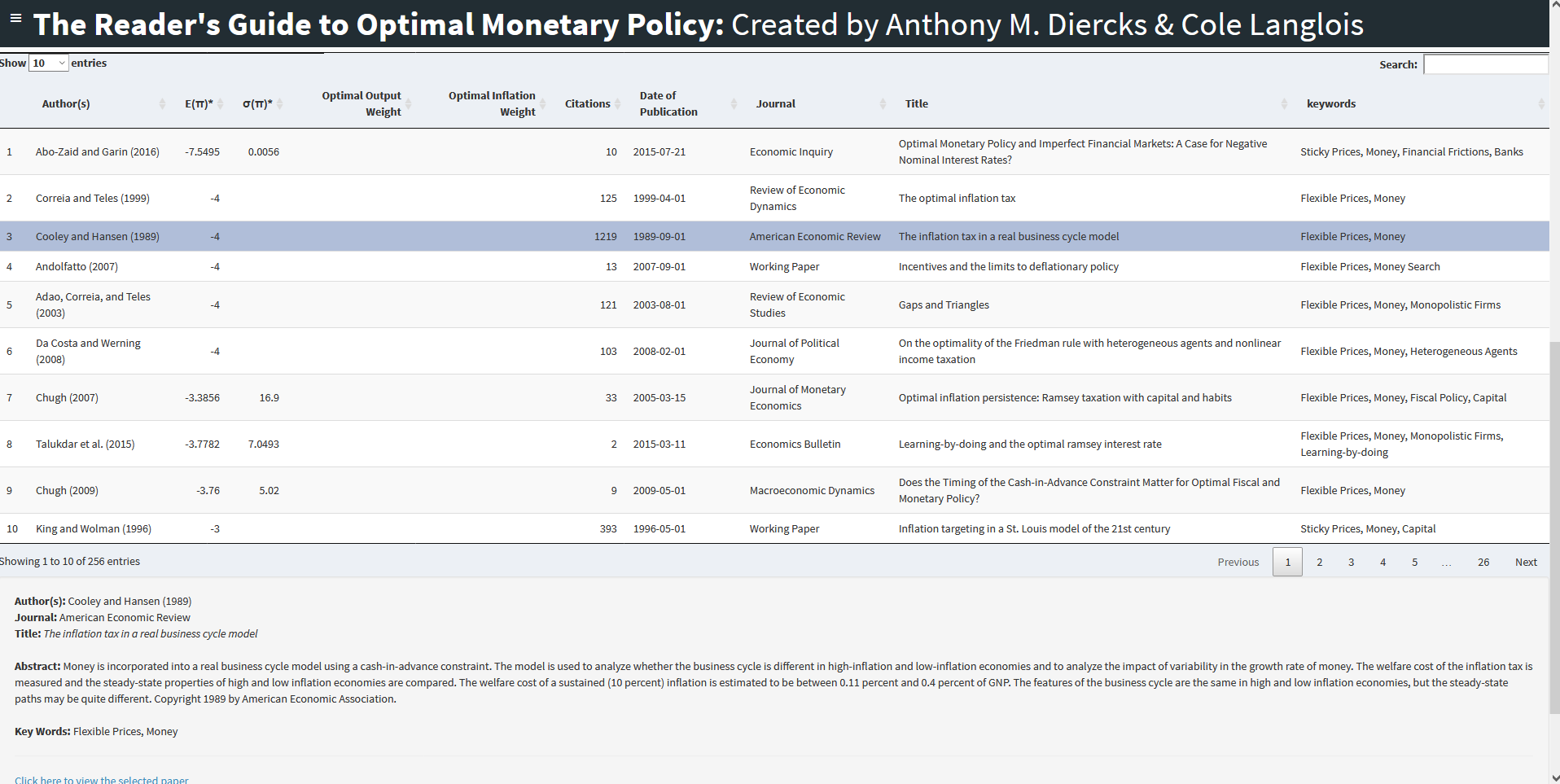

Abstract: We document some novel empirical evidence of significant time-varying skewness in the aggregate forecast distribution of the federal funds rate (FFR), i.e. asymmetric monetary policy expectations. To this end, we construct measures of the one-year ahead FFR expectations from responses to the Survey of Primary Dealers (SPD). The SPD provides a "physical” future distribution of the FFR, in contrast to measures extracted from asset prices. Importantly, this survey's unique feature allows us to explicitly compute mean and modal expectations and the discrepancy between the two measures, free of risk premia. We further show that a simple New-Keynesian model with the effective lower bound constraint can endogenously generate both positive and negative skewness similar to patterns in the data. The time-variation of asymmetry in the aggregate distribution highlights the importance of correctly measuring the mean when extracting FFR expectations from surveys. We argue that the FFR forecasts from the Blue Chip Survey (BCS), a popular survey measure of monetary policy expectations, track the mode more closely than the mean since 2011, when the data became publicly available. As a result, the mean measure of policy expectations extracted from the SPD implies significantly less negative term premia on average, compared to term premia implied by BCS forecasts. The mean measure also outperforms the BCS forecasts based on the mean squared error loss, consistent with the theory of optimal forecasting.

1 / 11

2 / 11

3 / 11

4 / 11

5 / 11

6 / 11

7 / 11

8 / 11

9 / 11

10 / 11

11 / 11

❮

❯

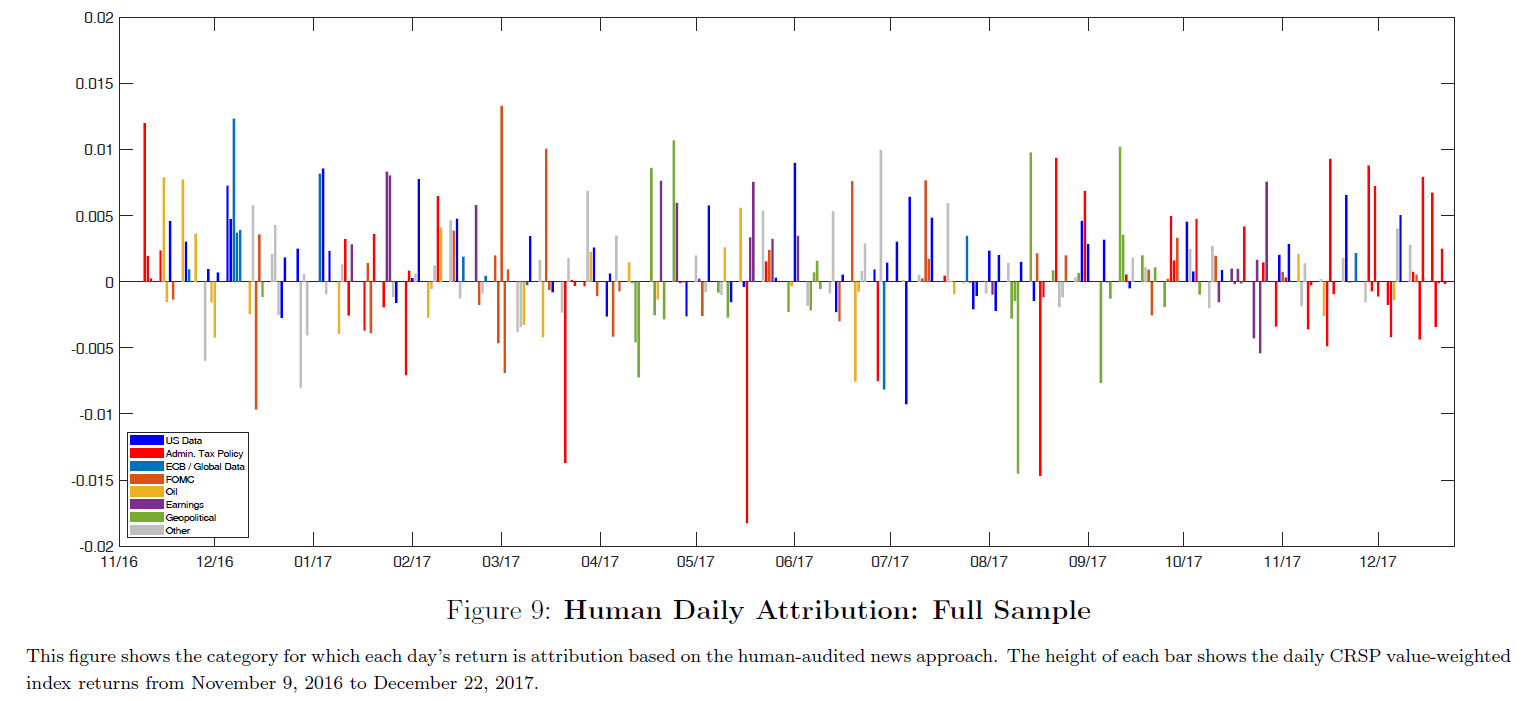

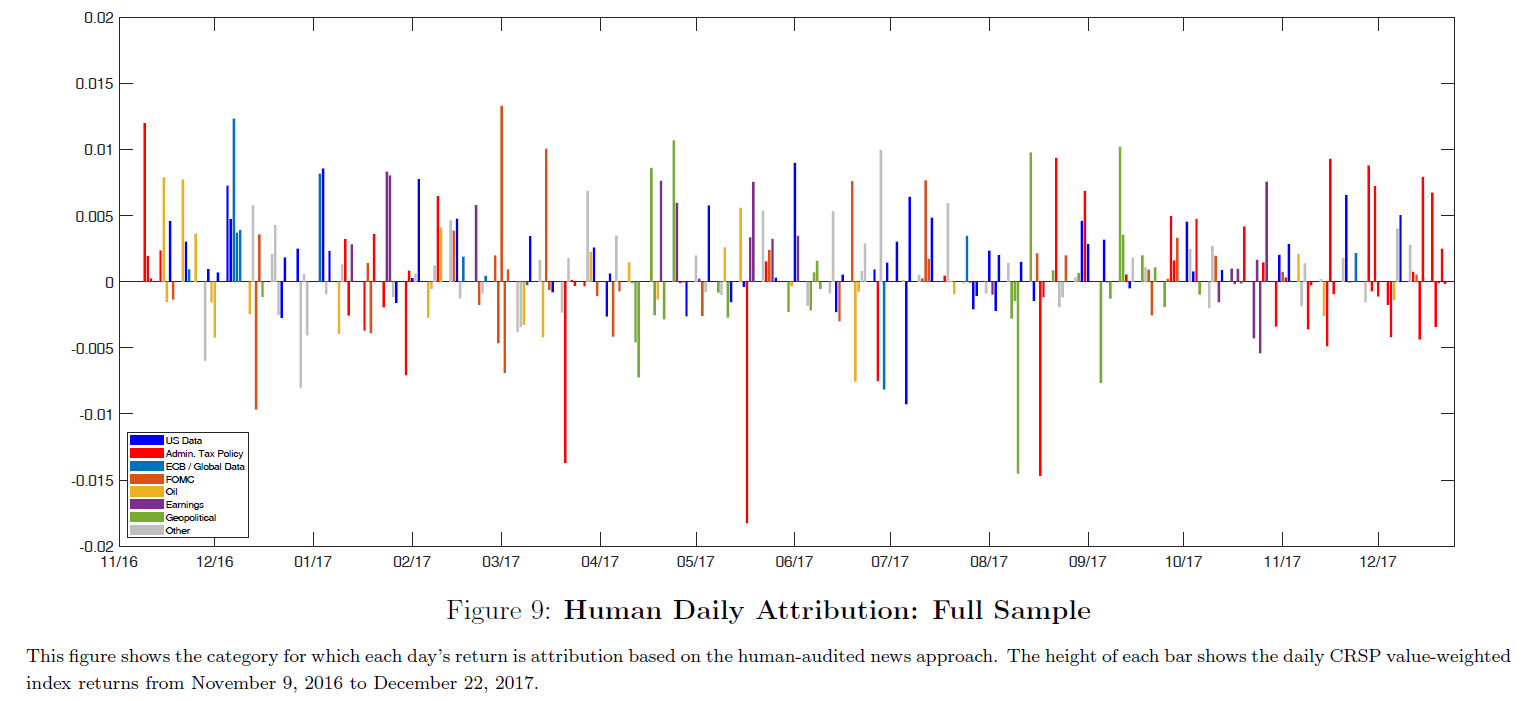

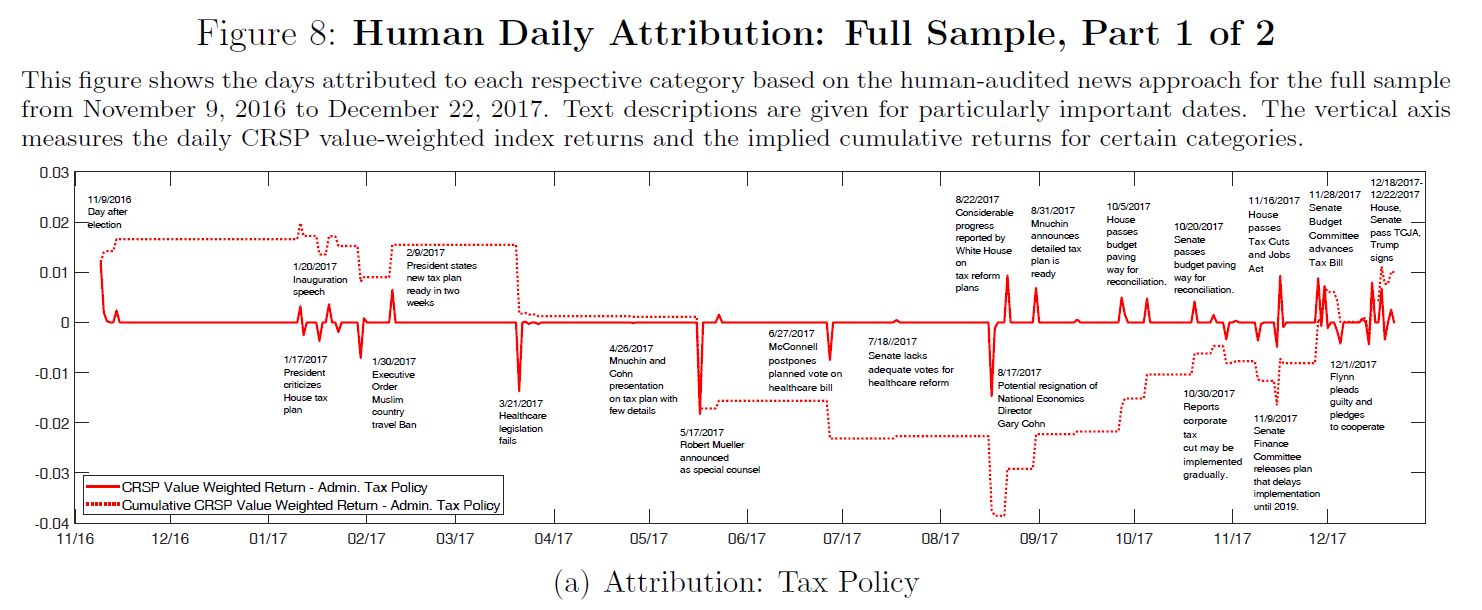

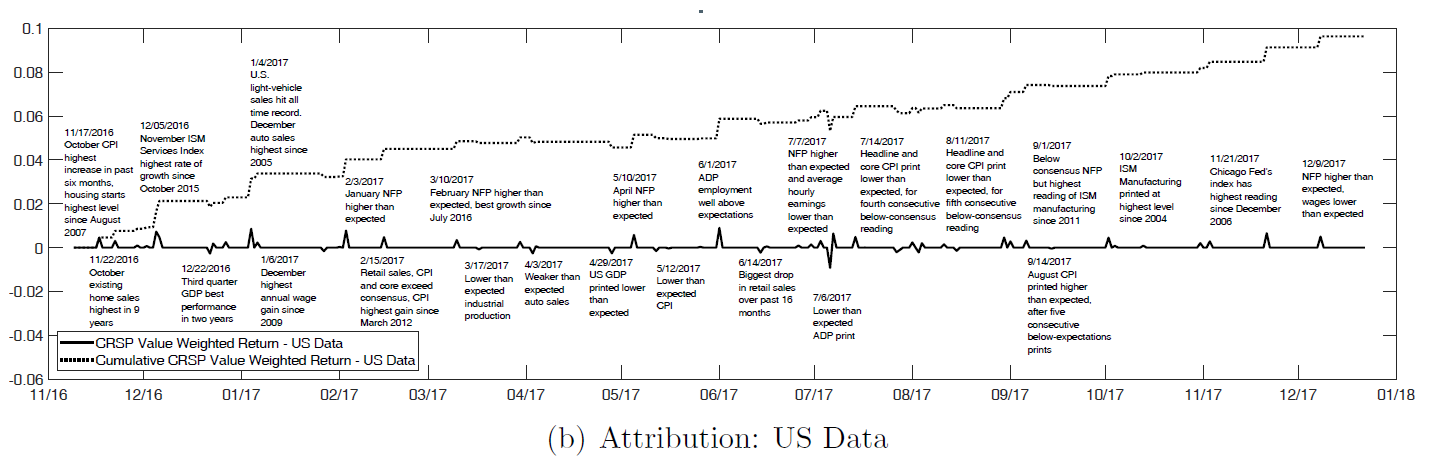

With D. Soques and W. Waller

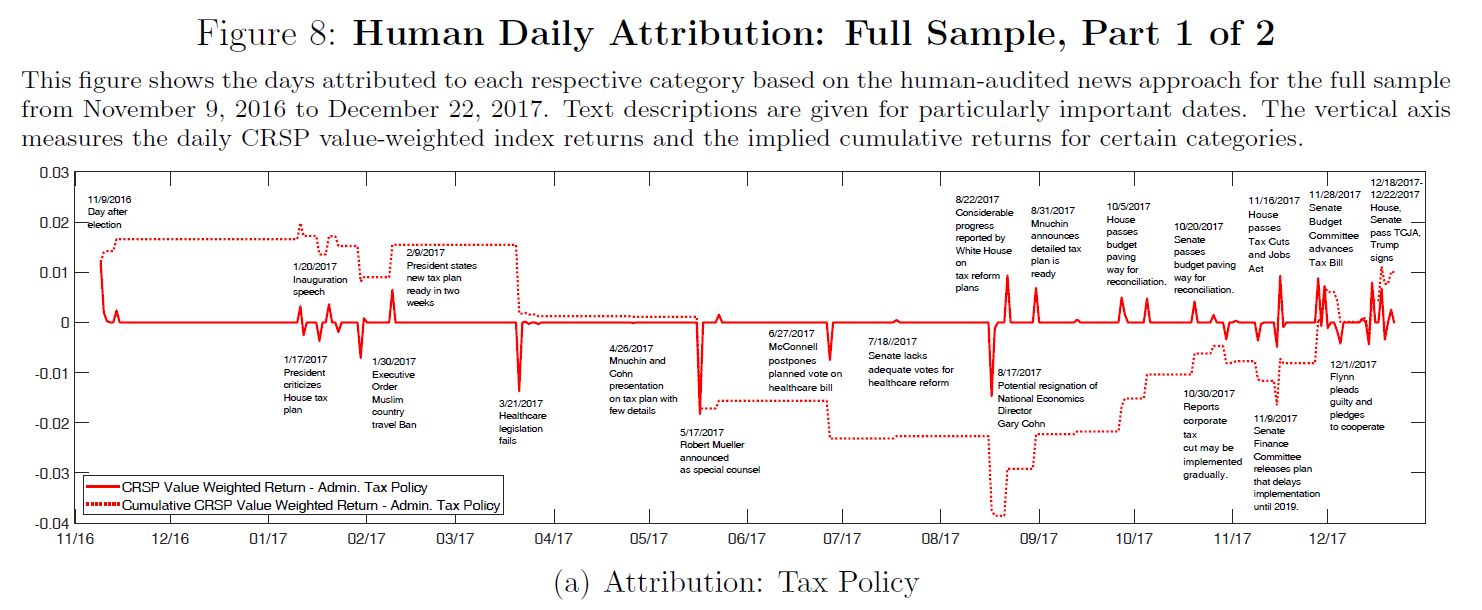

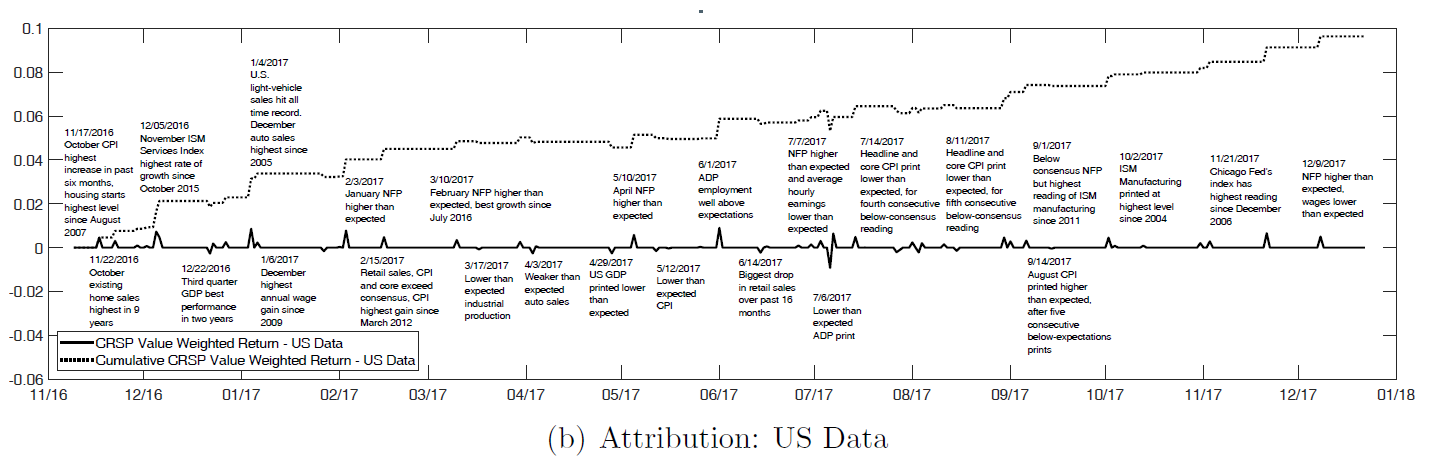

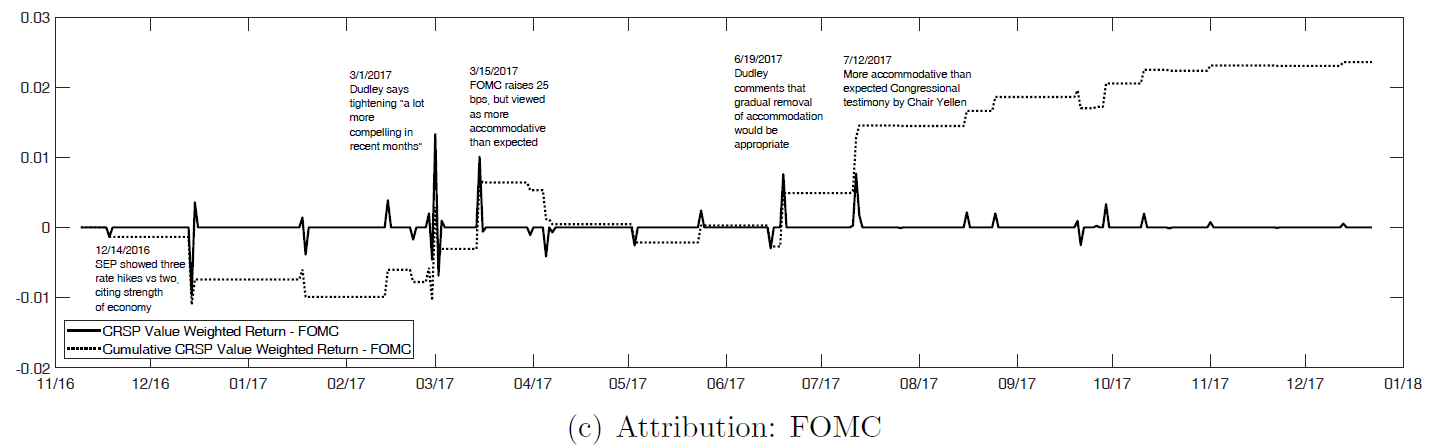

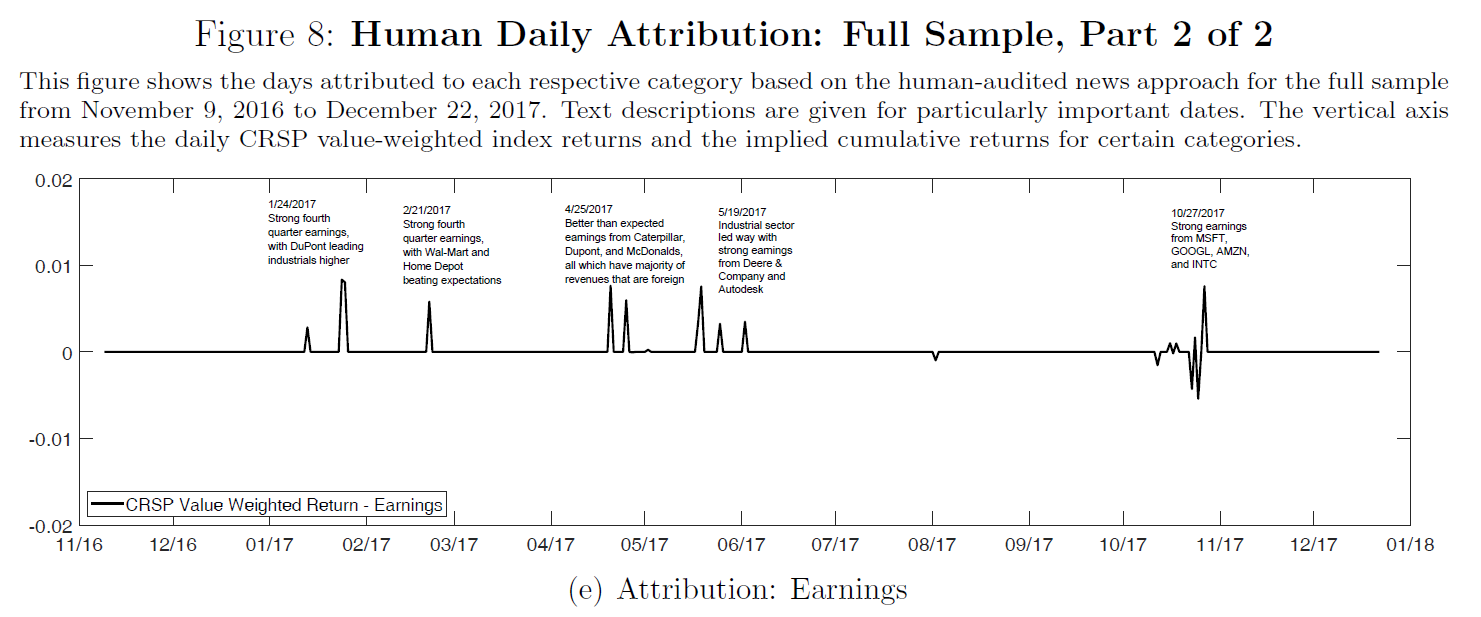

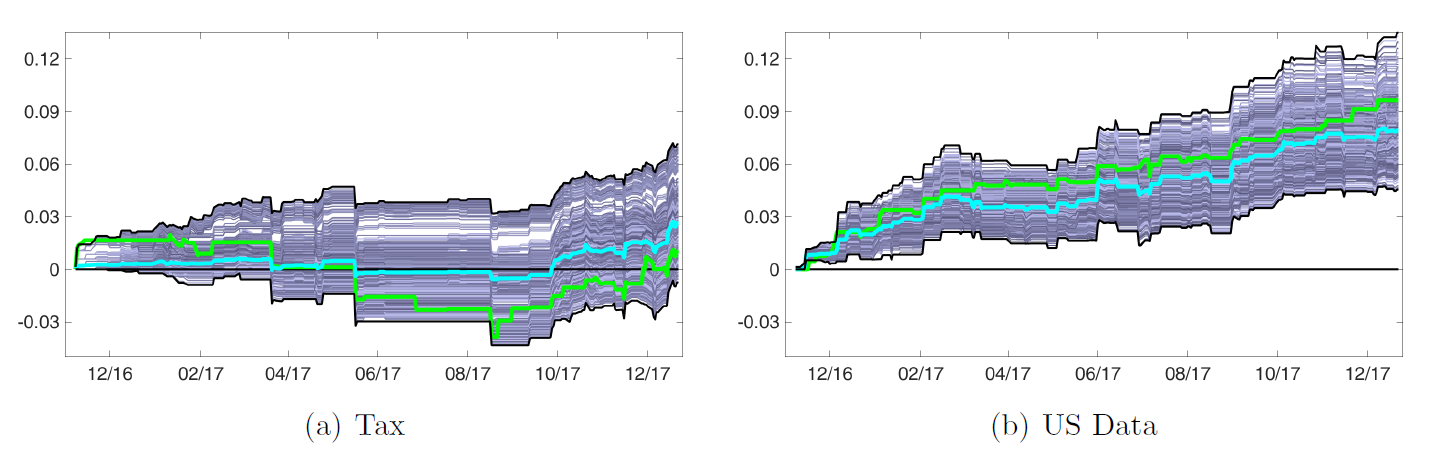

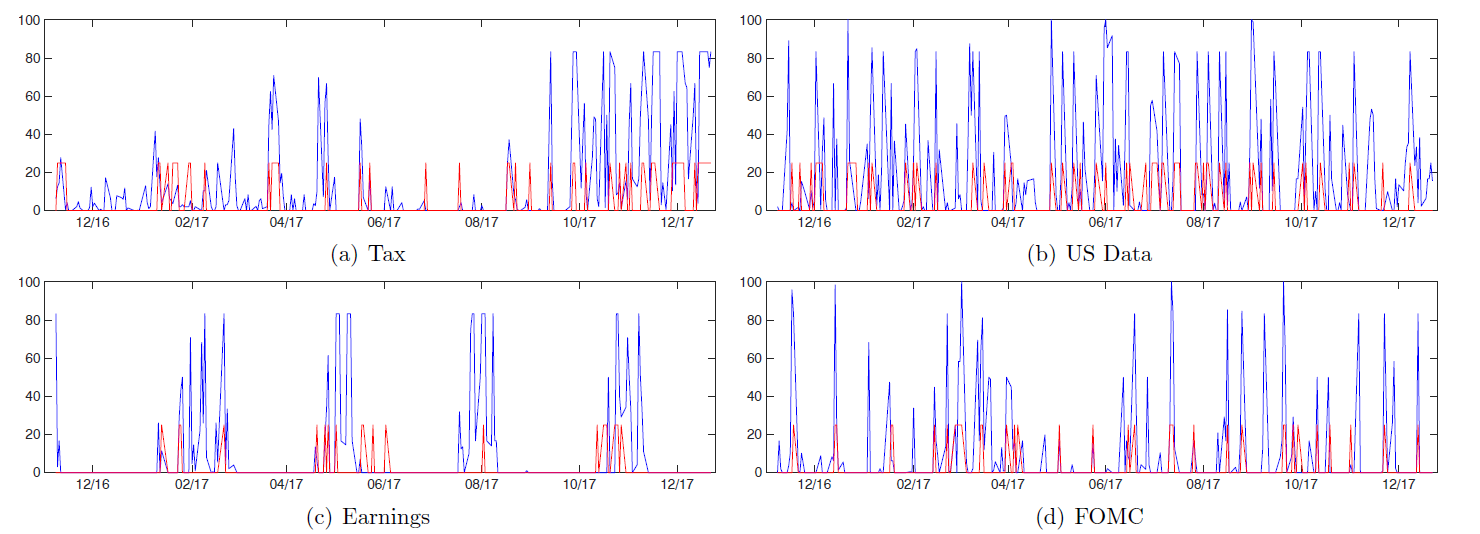

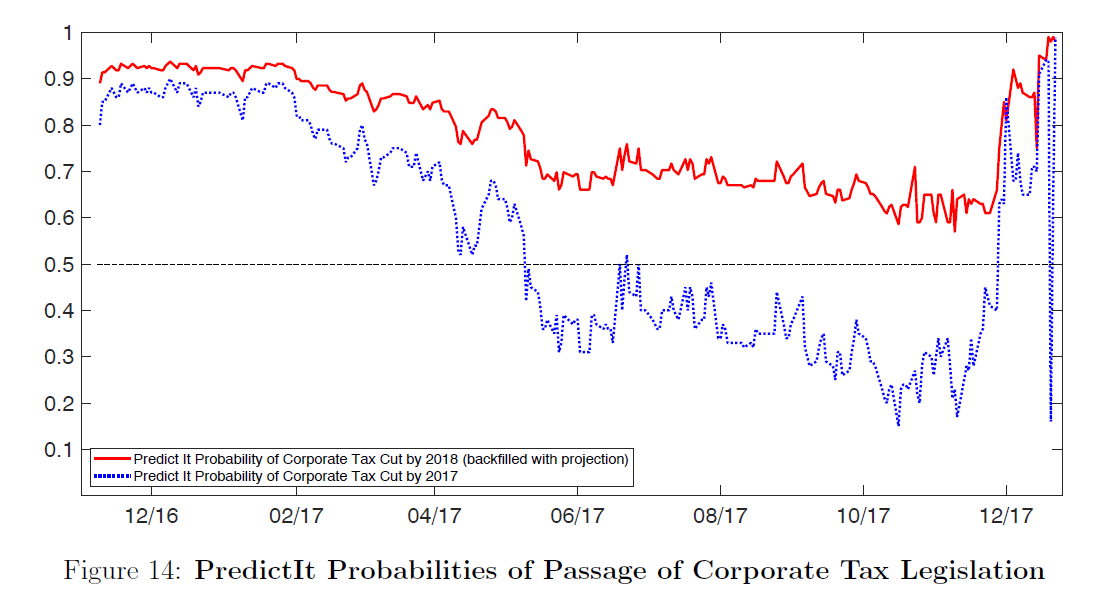

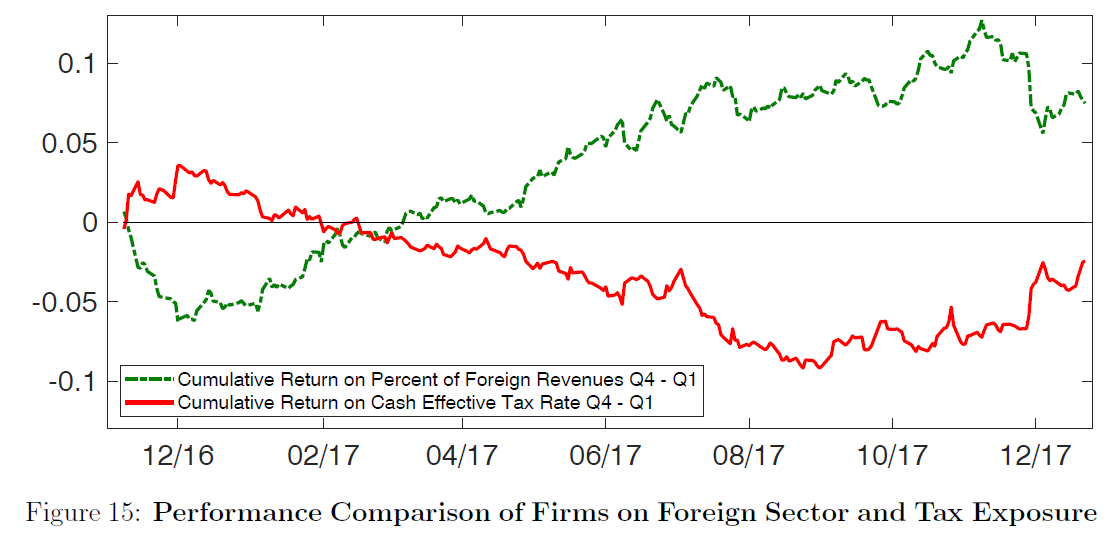

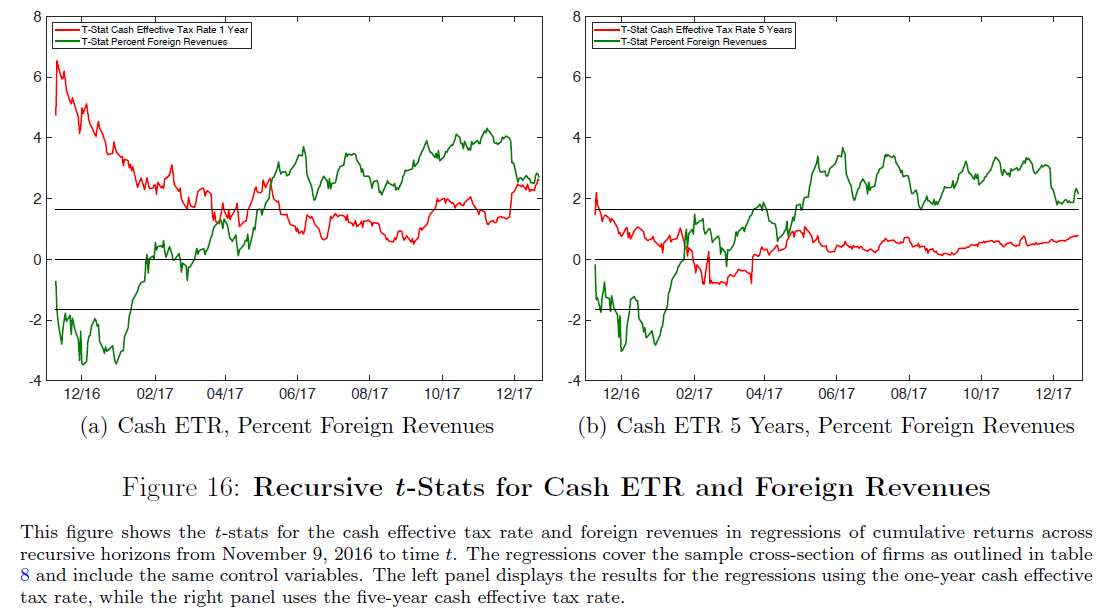

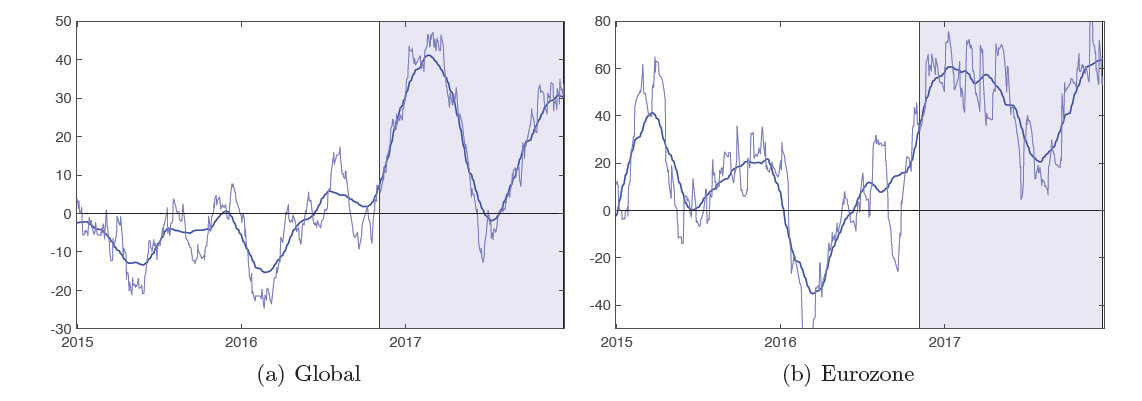

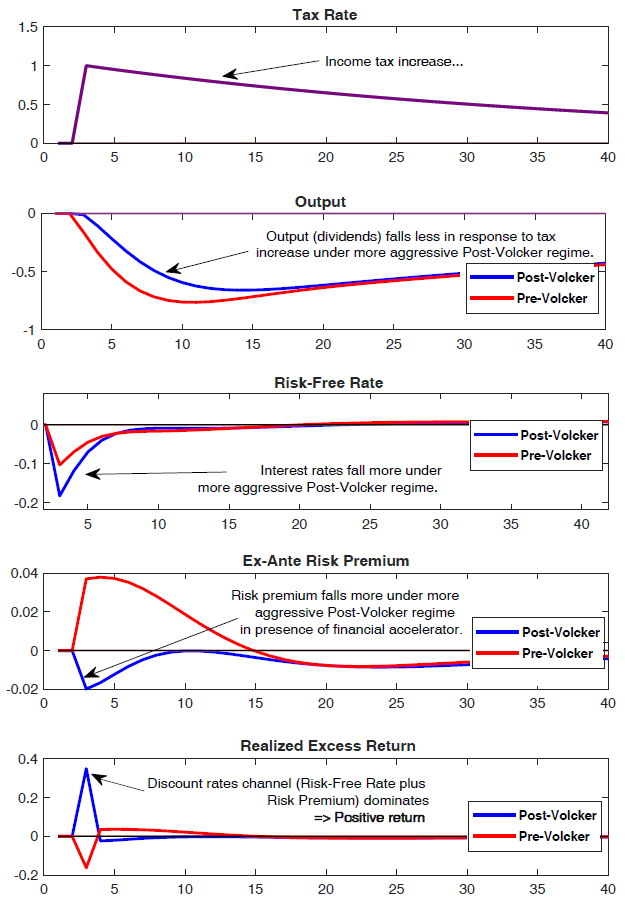

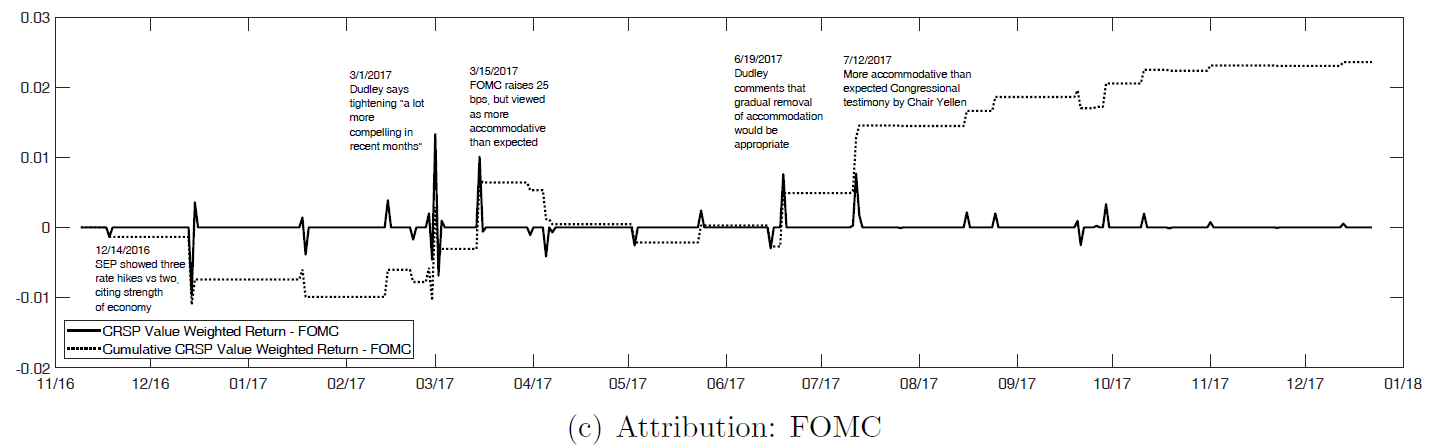

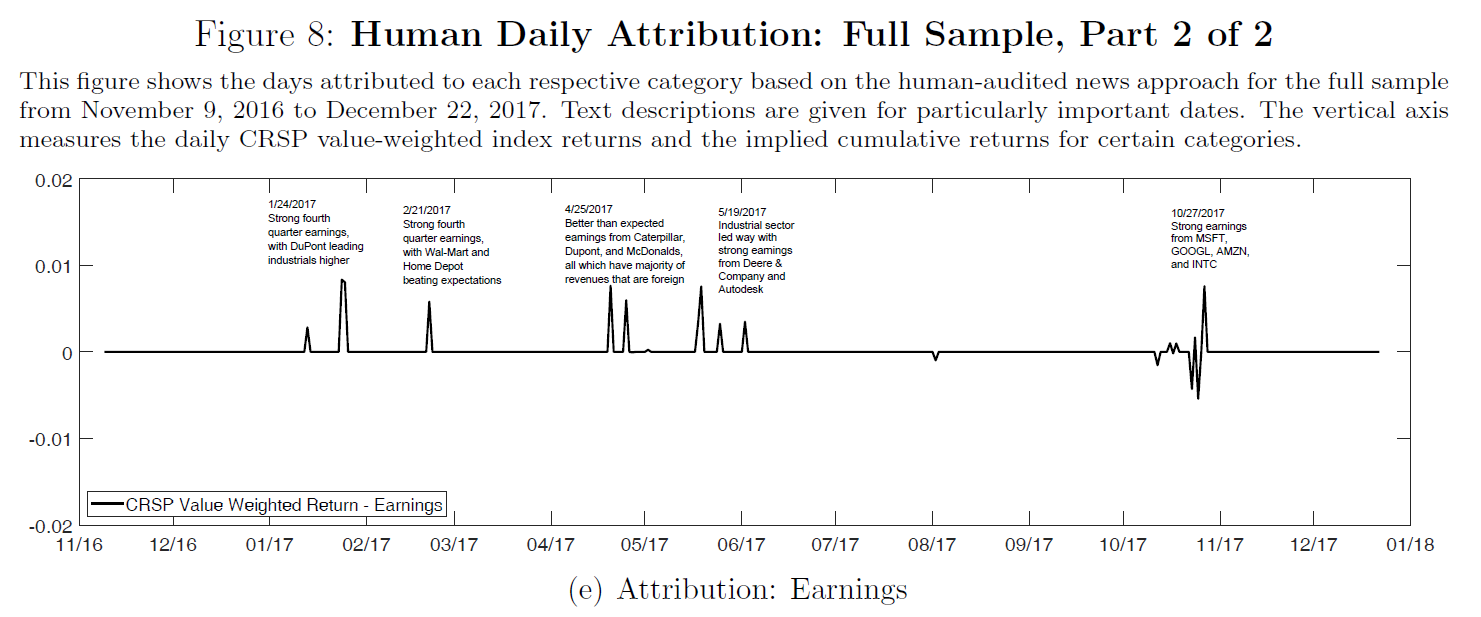

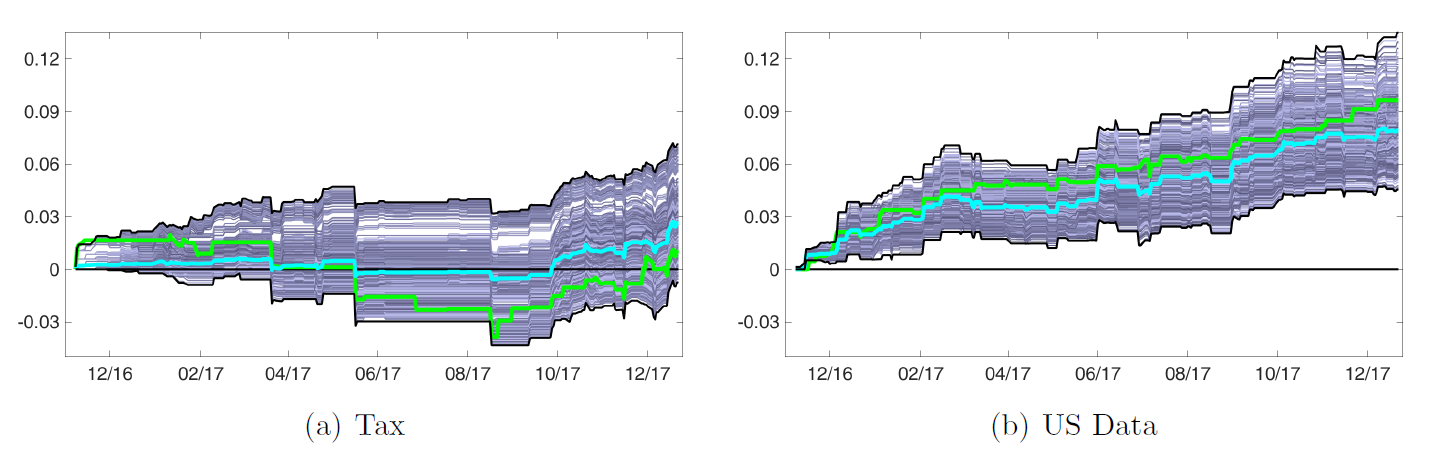

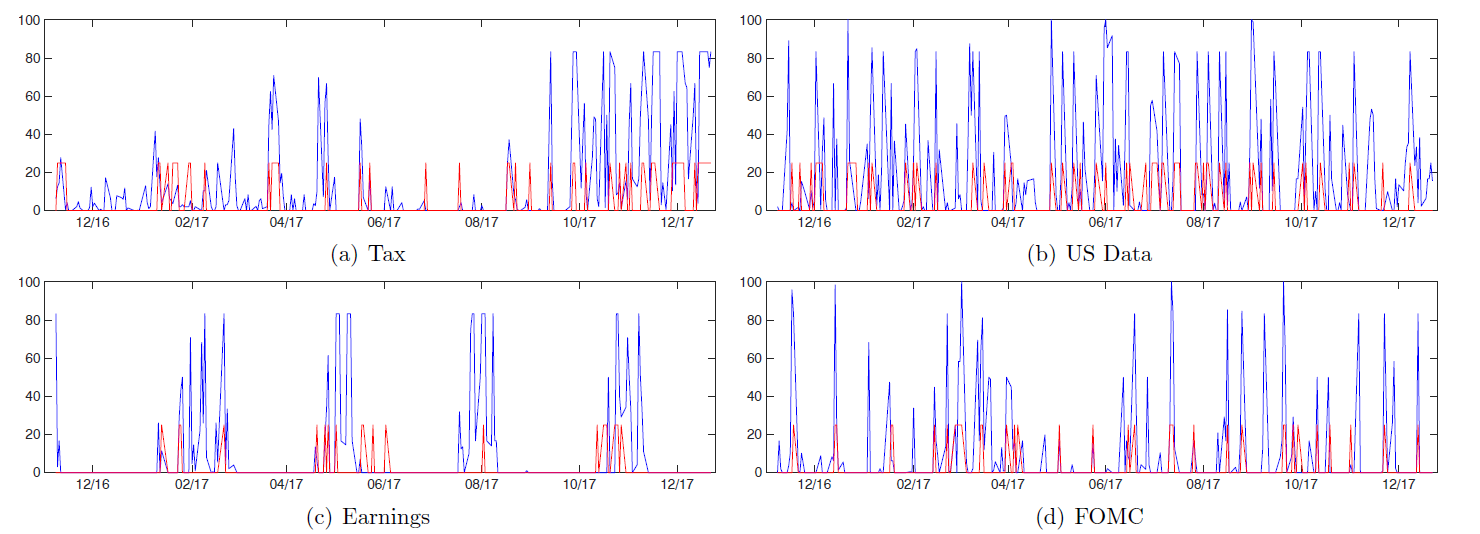

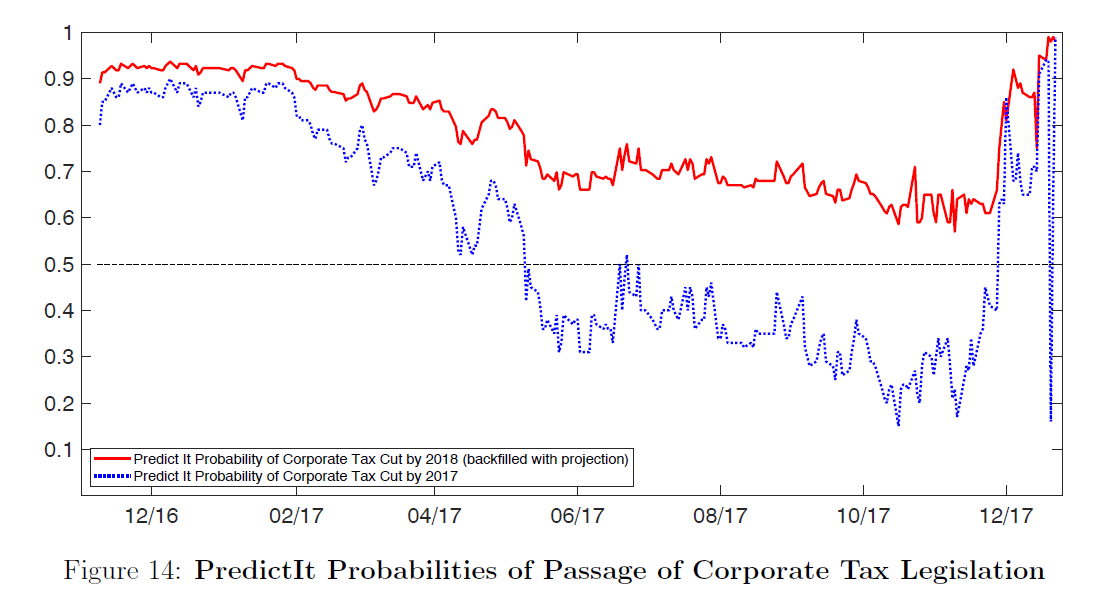

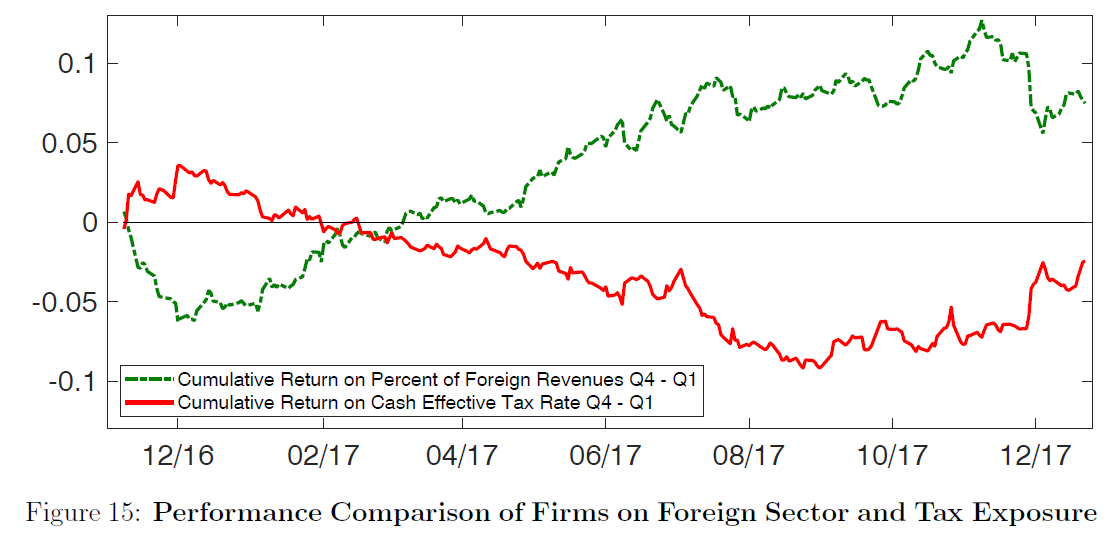

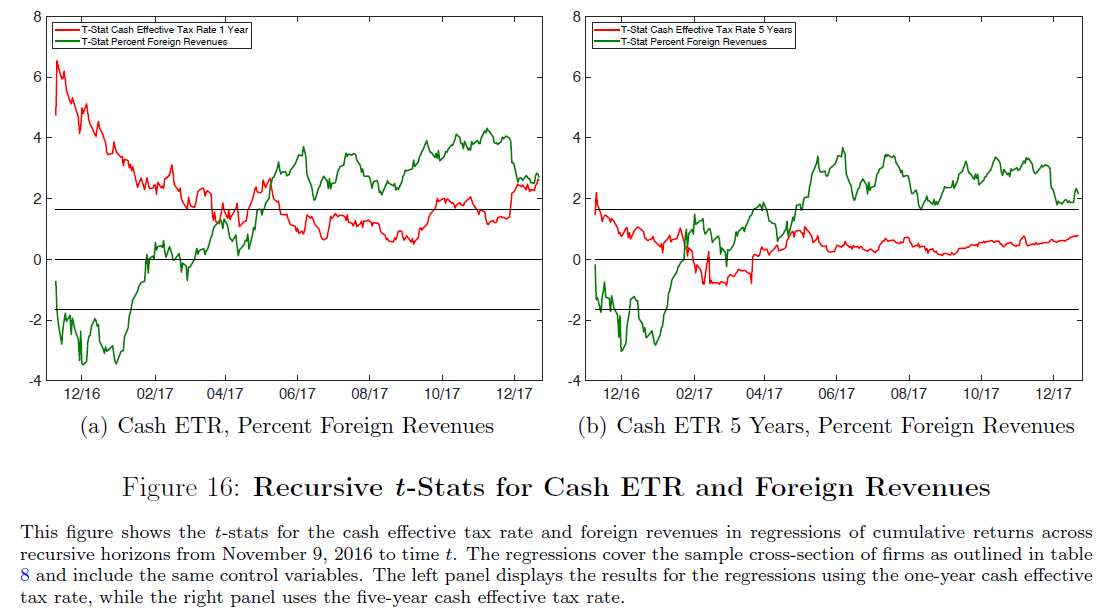

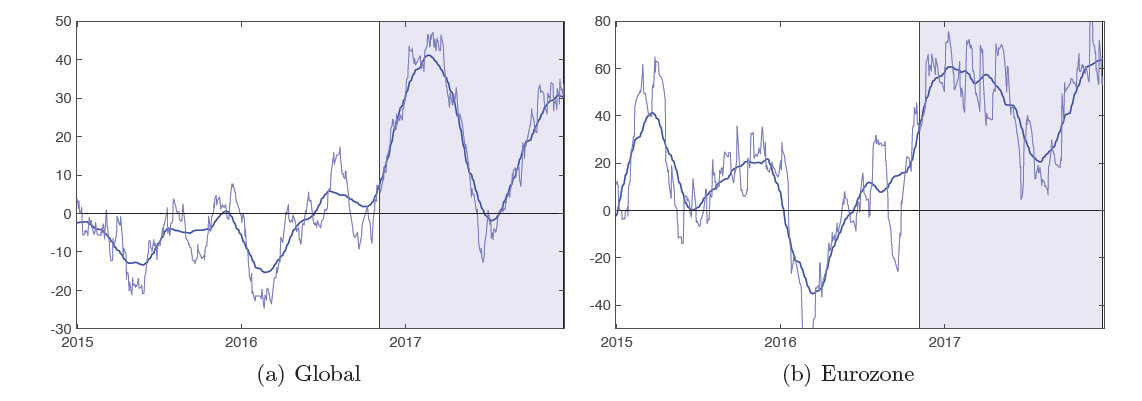

Abstract: Conventional wisdom suggests that the promise of tax legislation played an important and positive role in the 25% increase in the stock market that began on November 9, 2016 and continued through December 22, 2017 (the day TCJA was signed into law). Our comprehensive and exhaustive analysis confirms its positive effect. With that said, we find that its net impact is relatively modest. To come to this conclusion, we first construct a novel daily human-based attribution by carefully reading the news on each of the 283 days. This exercise shows the 52 days in which tax-related news was important make up less than 1% of the total observed return. We attribute large gains to tax-related news immediately after the election as well as the build-up to passage in late 2017. However, key events in the summer of 2017 decreased the prospects for tax legislation, which wiped out most of the gains that we attributed to tax policy over the full sample. This "up, down, and up again" narrative is corroborated across a wide-range of alternative approaches, including (1) a machine-driven textual analysis based on over 1,500 possible specifications, (2) a novel probability measure tied to the passage of tax legislation constructed from prediction markets, (3) the relative performance of high tax firms compared to low tax firms, (4) a daily attribution based on firm-level regressions, and (5) several macroeconomic financial indicators. The relatively modest estimated effects are consistent with the market potentially being more driven by strong global growth, changes in other policies, a weaker dollar (which coincided with a reduction in the likelihood of passage of tax legislation), and numerous below-expectations inflation prints (keeping monetary policy at bay) that fortuitously occurred over this time period.